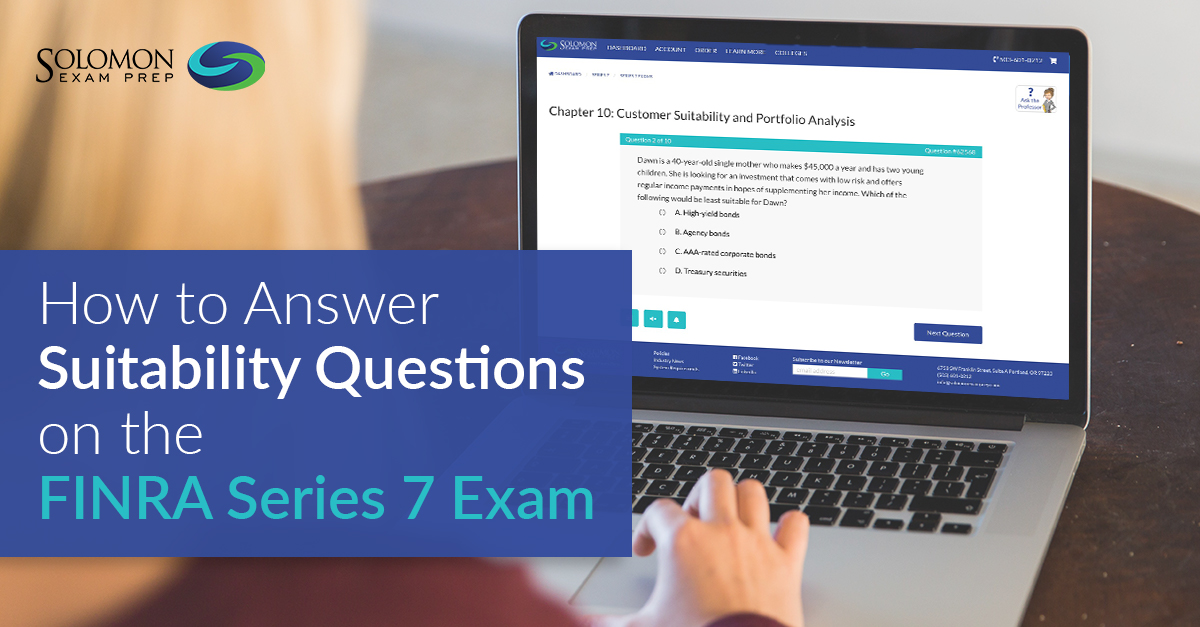

If you’re taking the FINRA Series 7 exam, you very possibly dread the term suitability. We understand that suitability questions may appear daunting. But to enhance your chances of passing the exam, you should have a good understanding of the concept and how it applies to certain test questions.

Suitability questions can be difficult because they often contain more than one answer choice that seems plausible. In short, they are more open-ended than other questions that appear on the exam. While this can make these questions tough, keep in mind that in each suitability question has one BEST answer given the information provided. This blog will help you select that that best answer choice.

First, what is a suitability question? The most basic type of suitability question presents a hypothetical investor and his profile and asks you which investment or investments is most suitable for him. Other suitability questions are about specific products. For instance, a question might ask you to choose the bond that would be most suitable for a high-income earner – usually a municipal bond. Finally, other types of suitability questions may provide an information about an investor and her profile and you will be asked which investments should be removed and/or added to her portfolio, or which proposed asset allocation is best.

So, what’s the best strategy for answering these questions?

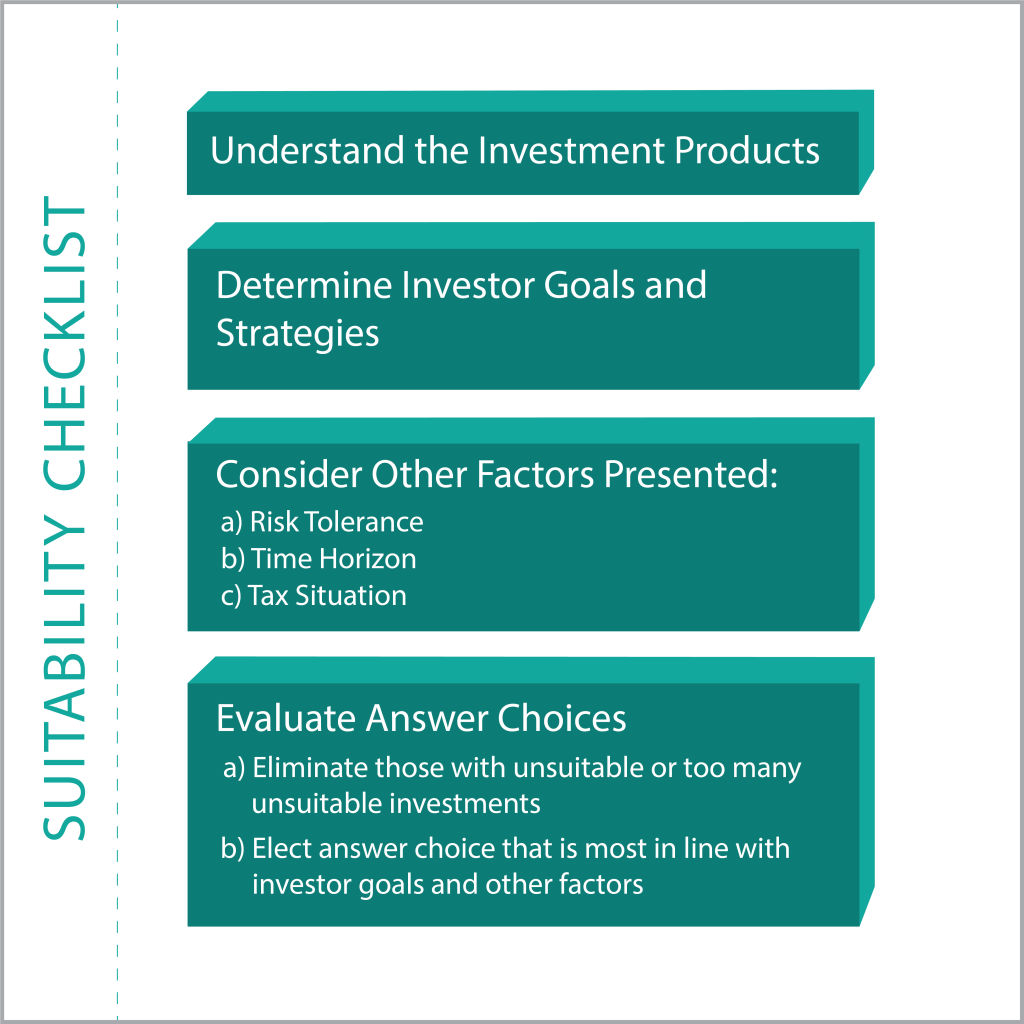

1. Learn and memorize the characteristics of the investment products.

The most basic requirement for properly approaching any of these questions is to have a good understanding of the investment products mentioned in the question. Think about it this way: if you don’t know the characteristics a product, it’s difficult to know who should and shouldn’t buy it. For instance, if you don’t know the characteristics of a growth fund or a municipal bond it will be hard to assess which investors should own these products or avoid them in favor of other products. This means learning and memorizing the characteristics of the major investment products, such as stocks, bonds, funds, and options, is the first step to mastering suitability.

2. Categorize the investment goals of the investor in the question.

Assuming that you understand the products mentioned in a question, let’s look at what else you should consider when answering a suitability question. First, when reading a suitability question, focus on the financial goals attributed to the hypothetical investor presented in the question.

There are four major investing goals and strategies that you should keep in mind when doing this. First, there are capital preservation investors. These investors are interested in obtaining a minimum level of return while not putting their principal at any significant risk. Then there are the income investors. These want to receive a steady stream of payments in hopes of supplementing their income. Third, there are capital growth investors. These are long-term investors whose primary hope is seeing the value of their investments rise over time. Finally, there are the speculative investors. These investors are willing to take on more risk in the hopes of earning higher gains in a shorter amount of time. Placing an investor in one of these categories, or a blend of two of these categories, will help you figure out which investments are most suitable for the investor.

3. Analyze the profile of the Investor, looking for risk tolerance, time horizon and tax bracket.

Risk Tolerance:

Look for the investor’s risk tolerance. If an investor is not willing to take on much risk, only the most conservative investments are suitable for him. In contrast, an investor with a high risk tolerance is willing to own more volatile types of investments. Typically, conservative risk tolerance correlates with capital preservation investors, and sometimes income investors, while high risk tolerance correlates with speculative investors and many capital growth investors. Examples of conservative investments include U.S. Treasury securities, money market funds, and bank CDs. Examples of high-risk investments include penny stocks, options, junk bonds, and possibly growth stocks.

Time Horizon:

An investor’s time horizon is another factor you must consider. Is the investor hoping for long-term growth, or is he going to need to cash out of his investments in a relatively short amount of time? Sometimes a question will not present you with this exact information but instead will give an investor’s age. Questions that mention an investor who is in his 20s or 30s are indicating someone with a long time horizon. In contrast, questions that describe an investor who only has a few years until retirement are usually describing someone with a shorter time horizon. Scenarios that describe a couple who wants to buy a house or pay for college in the next year, will also have a short time horizon, and therefore, will require liquid investments.

So which investments are best for long- and short-term investors? An investor with a long time horizon is able to invest in products that are expected to grow over time, such as growth stocks, equity mutual funds and ETFs, or annuities. He is also more likely to take on riskier investments since he has more time to make up for any losses. On the other hand, a short-term investor should invest in less volatile securities or debt investments that mature in the near term, such as U.S. Treasuries and money market funds. An investor with a short time horizon is also less likely to take on a high level of risk than a long-term investor because a short-term investor does not have as much time to make up any losses.

Tax Bracket:

A final factor to consider when determining suitability is income level or tax bracket. An investor who makes a lot of money will typically have a higher federal income tax rate. This means the money he receives from his investments will be more heavily taxed than the money someone in a lower tax bracket. Additionally, for a high income investor, capital gains are taxed at a lower rate than interest income. Oftentimes, it is best to recommend investments with fewer tax implications for a high-income investor. Municipal bonds, whose interest payments are usually tax-free at the federal level and often also tax-free at the state level, are typically suitable investments for high-income investors. In contrast, because the interest rates for municipal bonds are often lower than the interest rates for corporate bonds, investors in lower tax brackets may be better off purchasing corporate bonds than municipal bonds. Additionally, stocks are often suitable for investors with higher tax rates because their gains are not taxed until the stocks are actually sold. At the same time, investments that pay regular interest, but do not come with tax advantages may not be suitable for high-income investors because they will have to pay taxes on this interest.

So now that you know what to look for in suitability-type questions, let’s look at a couple of them:

QUESTION ONE: