Solomon Exam Prep and Pass Perfect, leading providers of education solutions for the securities industry, are joining forces to expand and advance the suite of products under the Pass Perfect brand. This merging of the two brands will strengthen the securities education offerings available from CeriFi, which acquired Pass Perfect in 2018 and Solomon Exam Prep in 2022.

“By harnessing the power of collaboration, we are poised to set new benchmarks in the securities training industry and drive tangible results for our clients,” said Lisa Stafford, Vice President of Licensing at CeriFi.

Individuals seeking to start or advance their career in the securities industry must pass licensing exams. Because these exams are comprehensive and rigorous, choosing an effective exam preparation program is important to ensure success.

Pass Perfect has spent the last few decades perfecting the science of preparing for securities licensing exams. Now, with the combined expertise and resources of Solomon Exam Prep and Pass Perfect, customers will benefit from an even more enriching educational experience that ensures success on their exams.

Leveraging the latest in Learning Science and Instructional Design, Pass Perfect’s study materials are designed to make studying more efficient. Customers have access to a variety of robust tools, such as study guides, video lectures, and practice exams, delivered on an innovative learning management system that personalizes their study experience for better results.

New and improved exam prep courses will be available from Pass Perfect starting in July 2023:

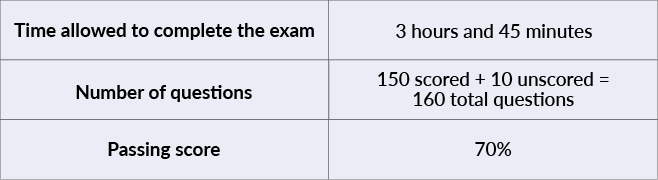

SIE, SIE+6, SIE+7, 3, 4, 6, 7, 9, 10, 9+10, 14, 22, 24, 26, 27, 28, 50, 51, 52, 53, 54, 57, 63, 65, 66, 79, 82, 99

ABOUT CERIFI

CeriFi is a diversified education, training and certification provider serving professionals across the financial services market. CeriFi’s broad suite of products delivers mission-critical results to individuals and professionals across the accounting, financial analysis, financial crime, financial planning, financial risk management, insurance, legal, securities licensing and tax industries. To date, CeriFi has acquired fourteen highly complementary companies, including Dalton Education, Money Education, Keir Financial Education, Pass Perfect, the CFP assets of LoneStar Financial Education, the Association of Certified Financial Crime Specialists (ACFCS), Bionic Turtle, CPMI, Fast Forward Academy, Spidell Publishing, MarkMeldrum.com, Solomon Exam Prep, Checkpoint Learning, and West LegalEdcenter. For additional information on CeriFi, see https://cerifi.com/.

ABOUT PASS PERFECT

Pass Perfect is a leading provider of FINRA licensing exam training to the financial services industry. Founded in 1988, Pass Perfect has successfully trained over 1 million securities professionals with its proprietary FINRA exam preparation solutions. Pass Perfect offers a comprehensive solution offering that is differentiated based upon its superior quality of content and unique interactive learning technology. For additional information on Pass Perfect, see https://www.passperfect.com/.

ABOUT SOLOMON EXAM PREP

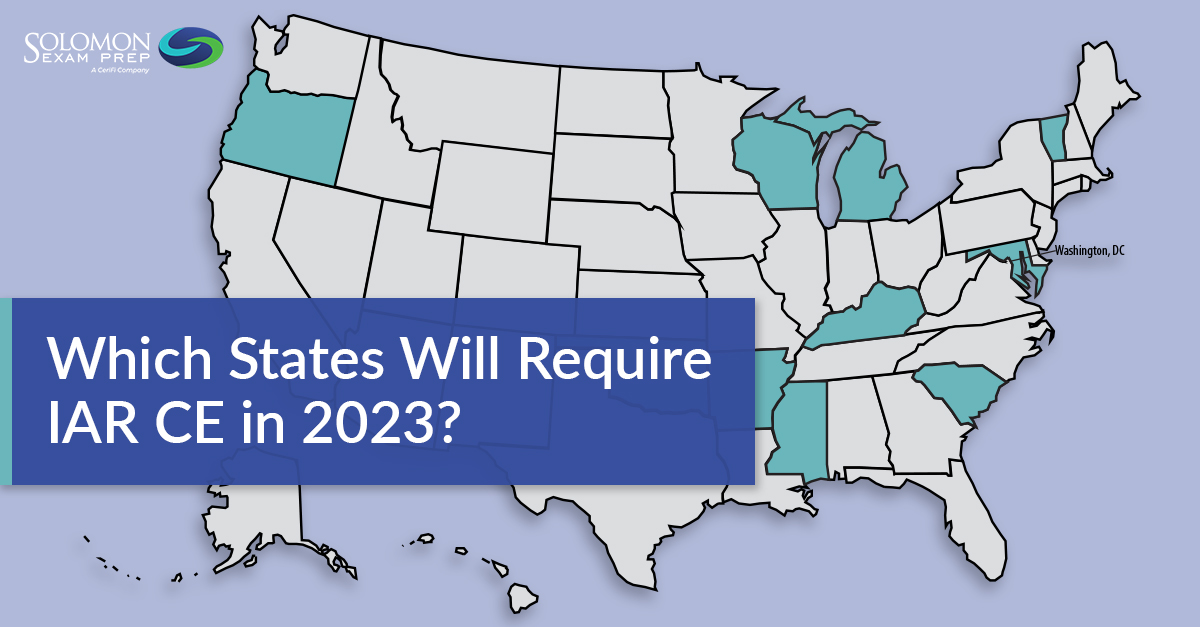

For over 15 years, Solomon Exam Prep helped thousands of financial professionals and students pass their FINRA, MSRB, NASAA, and NFA securities licensing exams, including the SIE and the Series 3, 6, 7, 14, 22, 24, 26, 27, 28, 50, 51, 52, 53, 54, 63, 65, 66, 79, 82, and 99. In 2022, Solomon Exam Prep was among the first providers to offer Investment Adviser Representative Continuing Education. For additional information on Solomon Exam Prep, see https://solomonexamprep.com/.

Media Contact:

Lindsey Salens

Marketing@cerifi.com