What is the Series 99 exam?

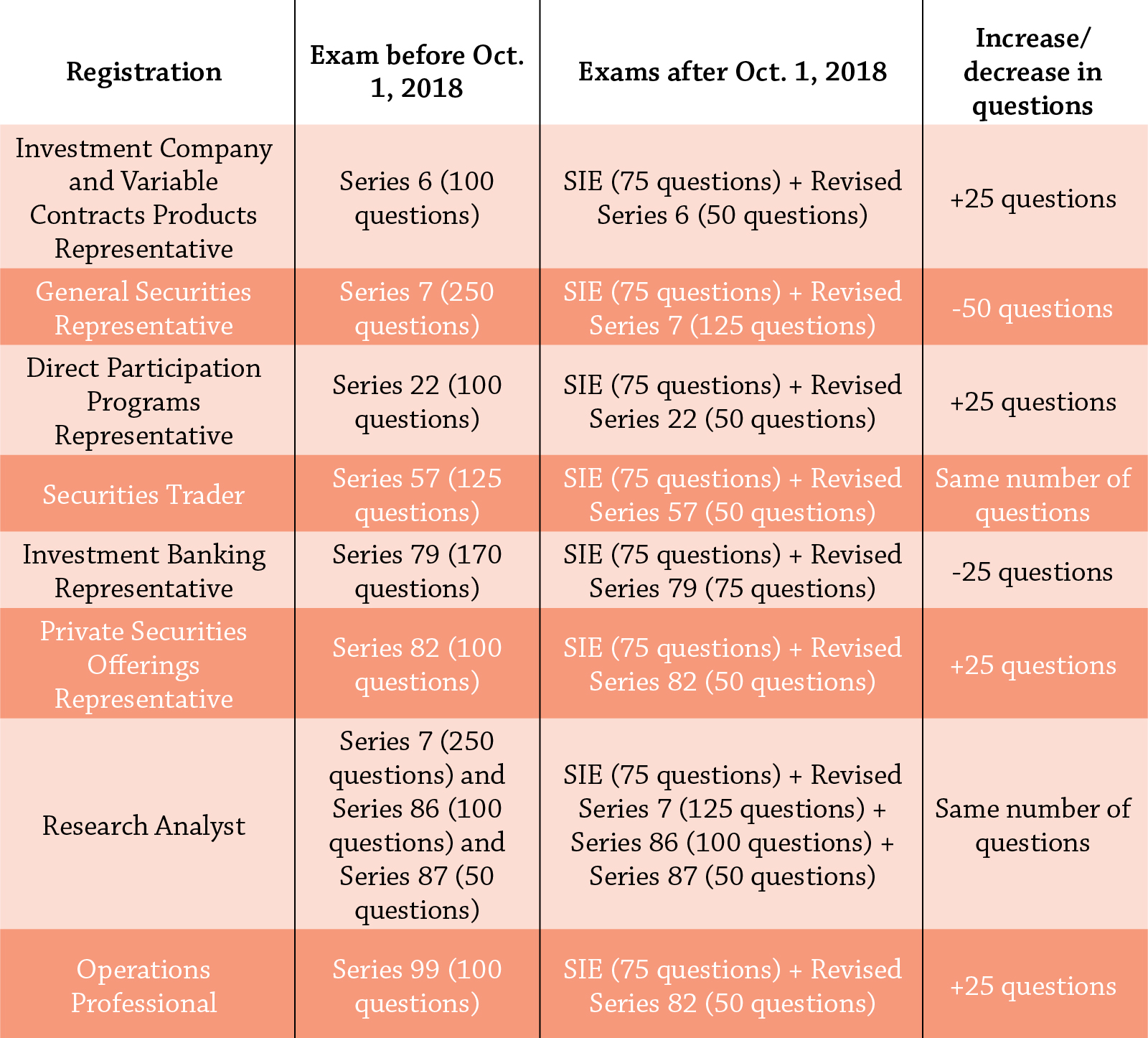

The Series 99, also called the Operations Professionals Exam, is a FINRA (Financial Industry Regulatory Authority) exam. FINRA is an independent, self-regulatory organization that creates and enforces rules for registered broker-dealer firms and their representatives. FINRA is also responsible for administering securities licensing exams, such as the Securities Industry Essentials (SIE) exam, Series 7 exam, Series 99 exam, and many more.

The Series 99 exam measures the knowledge of entry-level registered representatives to perform their duties as Operations Professionals. The exam will help you understand your professional responsibilities, including key regulatory and control requirements. It will assess your broad understanding of the following:

-

- The operations functions that support a broker-dealer’s business

- The regulations that are designed to achieve investor protection and market integrity

- The regulations that drive operations processes and procedures conducted at a broker-dealer

- Regulatory red flag issues and the ability to identify and address these issues to the appropriate persons within the member firm and/or to a regulatory body, if necessary

What does the Series 99 permit me to do?

Obtaining a Series 99 qualification will permit you to perform crucial functions in a broker dealer’s operations department. Duties may include customer onboarding, financial control, stock loan/securities lending, trade confirmation, and issuing account statements.

Are there any prerequisites for the Series 99?

Yes, you must also pass the co-requisite Securities Industry Essentials (SIE) exam to obtain the Series 99 qualification. To take the Series 99 exam, you must be employed and sponsored by a FINRA-member firm.

Can I register as an Operations Professional without passing the Series 99 exam?

If you hold any of the following registrations, you can qualify as an Operations Professional without taking the Series 99 exam:

-

- Registered Options Principal (Series 4)

- Investment Company Products/Variable Contracts Representation (Series 6)

- General Securities Representative (Series 7)

- General Securities Sales Supervisor (Series 9/10)

- Compliance Officer (Series 14)

- Supervisory Analyst (Series 16)

- General Securities Principal (Series 24)

- Investment Company Products/Variable Products Principal (Series 26)

- Financial and Operations Principal (Series 27)

- Introducing Broker-Dealer Financial and Operations Principal (Series 28)

- Municipal Fund Securities Limited Principal (Series 51)

- Municipal Securities Principal (Series 53)

About the Exam

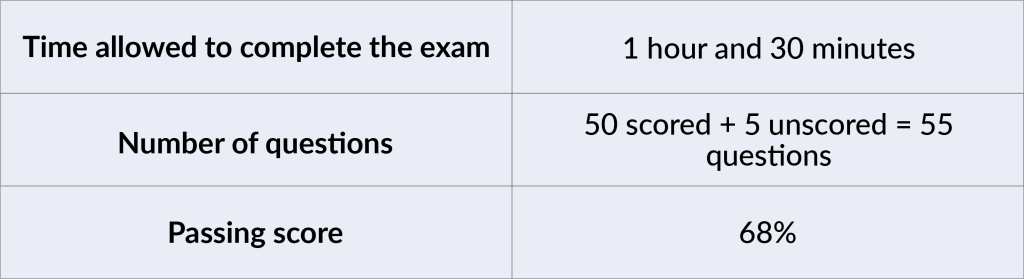

The Series 99 exam consists of 50 scored and five unscored multiple-choice questions. The five unscored questions are experimental questions and appear randomly.

Note: Scores are rounded down to the next lowest whole number (e.g. 67.9% would be a final score of 67%–not a passing score for the Series 99 exam).

Topics Covered on the Exam

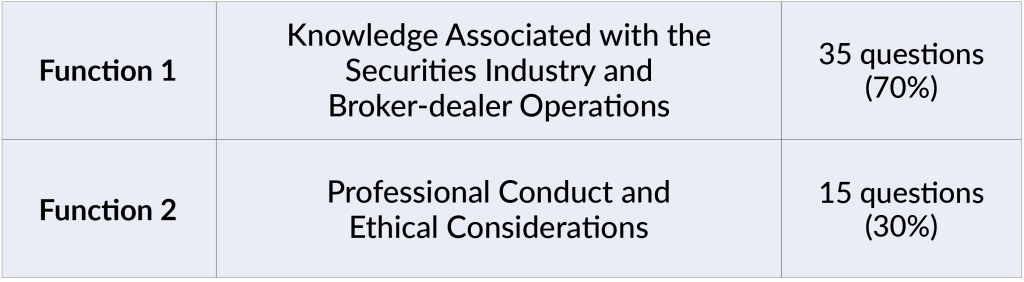

FINRA divides the questions on the Series 99 exam into two parts representing the two major job functions of an Operations Professional.

FINRA updates its exam questions regularly to reflect the most current rules and regulations. Solomon recommends that you print out the current version of the FINRA Series 99 Content Outline and use it in conjunction with the Solomon Series 99 Study Guide. The Content Outline is subject to change without notice, so make sure you have the most recent version.

Series 99 Example Questions

The Series 99 exam consists of multiple-choice questions, each with four options. You may see the following question structures. However, keep in mind that these sample questions don’t necessarily represent the difficulty level or subjects covered in the exam.

Closed Stem Format:

This item type asks a question and gives four possible answers to choose from.

Which of the following is not a factor that can be used to determine whether securities were not delivered in good form and are therefore subject to possible rejection?

-

- Improper endorsements

- Late arrival

- Erroneously cancelled coupons

- Damaged or mutilated certificates

Open Stem Format:

This kind of question has an incomplete sentence followed by four possible conclusions.

Shoestring Discount Stock Jocks owns no shares of stock in any exchange-traded companies. In its efforts to execute a buy order for your account, it would be acting as a:

-

- Broker-dealer

- Dealer

- Broker

- None of the choices listed

“Except” (or “Not”) Format:

This type requires an answer that is incorrect or is an exception among the four answer choices.

All of the following are definitely DTC-eligible securities, except:

-

- A stock that trades on the NYSE

- A stock that trades on Nasdaq

- An OTC security

- A bond that trades on the NSYE

- Answers: 1. B 2. C 3. C

Try a free sample of Solomon Exam Prep’s Series 99 Exam Simulator. You’ll receive instant feedback on each question with a robust explanation of the correct answer.

Taking the Series 99 Exam

FINRA administers the Series 99 exam, and you must take it at a Prometric test center. The exam is given via computer. Before the exam starts, you’ll take a tutorial on how to take the exam. After you finish the tutorial, the exam will begin and you’ll have one hour and 30 minutes to complete it.

Like all qualifying exams in the securities industry, the Series 99 is closed-book, and you’re not allowed to bring anything into the exam. The test center will provide you with any materials you need to complete the exam. For instance, the test center may provide a whiteboard with markers or scratch paper and a pencil, as well as a basic electronic calculator. Or, a digital calculator and notepad will be available within the computer testing platform.

The inspection and sign-in requirements at test centers are stringent, so plan to arrive at least 30 minutes before your scheduled test appointment.

Test-Taking Tips

When taking the exam, it helps to keep some test-taking strategies in mind. Try not to spend too long on one question—this may cause you to run out of time and not get to other questions you know. If you don’t know the answer to a question, guess at the answer and mark it for review . There’s no penalty for guessing, so it’s beneficial to answer every question.

After you’ve finished all the questions, you can return to any flagged questions. This strategy allows you to efficiently answer the ones you know. You might also learn something later in the exam that helps you answer an earlier question. Just remember to save enough time to return to the questions you didn’t answer. However, it’s not a good idea to simply skip all of the difficult questions with the plan to answer them later. You should make a serious effort to answer each question before moving on to the next one since your thoughts are often clearer earlier on during the exam.

How to Study for the Series 99 Exam

Follow Solomon Exam Prep’s proven study system:

-

- Read and understand. Read the Solomon Study Guide, carefully. Many students read the Study Guide two or three times before taking the exam.

- Take chapter quizzes in the Exam Simulator. When you finish reading a chapter in the Study Guide, take 4–6 chapter quizzes in the Exam Simulator. Use these quizzes to give yourself practice and to find out what you need to study more. Make sure you read and understand the question rationales.

- Take full practice exams in the Exam Simulator. When you’ve finished reading the entire Study Guide, review your handwritten notes once more. Finally, start taking full practice exams in the Exam Simulator. Aim to pass at least six full practice exams and try to get your average score to at least 80%. When you reach that point, you’re probably ready to sit for the Series 99 exam.

Use these effective study strategies:

-

- Take handwritten notes. As you read the Study Guide, take handwritten notes and review your notes every day for 10–15 minutes. Studies show that taking handwritten notes in your own words and then reviewing them strengthens learning and memory.

- Make flashcards. Making your own flashcards is another proven method to reinforce memory and strengthen learning.

- Research. Research anything you don’t understand. Curiosity = learning. Students who take responsibility for their own learning by researching anything they don’t understand get a deeper understanding of the subject matter and are much more likely to pass.

- Become the teacher. Studies show that explaining what you’re learning greatly increases your understanding of the material. Ask someone in your life to listen and ask questions, or explain it out loud to yourself. Studies show this helps almost as much as explaining to an actual person (see Solomon’s blog post to learn more about this strategy!).

Take advantage of Solomon’s supplemental tools and resources:

-

- Use all the resources. The Series 99 Resources folder in your Solomon student account has helpful study tools, including documents that summarize important exam concepts. There’s also a detailed study schedule that you can print out – or use the online study schedule and check off tasks as you complete them.

- Watch the Video Lecture. This provides a helpful review of the key concepts in each chapter after reading the Solomon Study Guide. Take notes to help yourself stay focused.

- Use Ask the Professor. If you have a content-related question, click the Ask the Professor button in your account dashboard and get personalized help from a Solomon professor.

-

Good practices while studying:

- Take regular breaks. Studies show that if you’re studying for an exam, taking regular walks in a park or natural setting significantly improves scores. Walks in urban areas or among people did not improve test scores.

- Get enough sleep. Sleep consolidates learning into memory, studies show. Be good to yourself while you’re studying for the Series 99: exercise, eat well, and avoid activities that will hurt your ability to get a good night’s sleep.

You can pass the FINRA Series 99 exam! It just takes focus and determination. Solomon Exam Prep is here to support you on your path to becoming an Operations Professional.

Explore all Solomon Series 99 exam prep, including the Study Guide, Exam Simulator, and Video Lecture.

And join the Solomon email list to hear about new product releases, industry news, and more! Just click the button below: