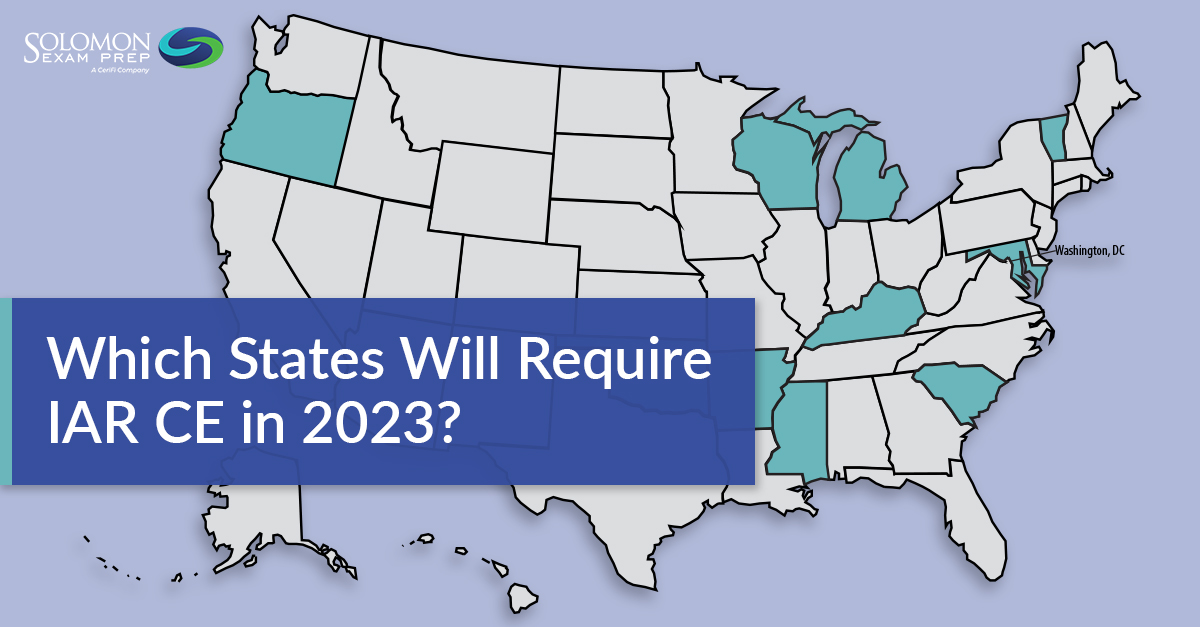

Solomon Exam Prep has added two new courses to its Investment Adviser Representative Continuing Education course library. The courses, “Options 101” and “Recommending Complex Products,” are approved by NASAA to earn credit towards the CE requirement for investment adviser representatives (IARs), which is currently in effect in eleven U.S. jurisdictions.

Options 101

This course explores the basics of equity options, options strategies, and non-equity options. The course begins by defining and describing call options and put options. Important options concepts are explained, such as long versus short positions, American versus European-style options, opening versus closing positions, intrinsic versus time value, and types of settlement. Participants will learn how to calculate their gains and losses from options transactions, as well as how to use options for hedging, income and speculation. Non-equity options, such as index options, foreign currency options, and FLEX Options are also described. Finally, the course summarizes the benefits and risks of options, in addition to the most relevant concerns of regulators regarding options trading.

By the end of the course, you’ll be able to do the following:

- Understand the basic principles of options.

- Calculate the gains and losses of options transactions.

- Understand basic characteristics of options, such as American versus European-style options, how to open and close positions, intrinsic value versus time value, and settlement methods.

- Understand how to use options for hedging positions, generating income and speculating.

- Identify the basic characteristics of non-equity options, such as index options, foreign currency options, and FLEX options.

- Describe risks and benefits of trading options and the current topics of greatest concern for regulators regarding options trading.

The Options 101 course is worth one credit for the Products and Practices category. To fulfill the yearly 12-credit CE requirement, IARs must complete six credits in this category and six credits in the Ethics and Professional Responsibility category.

Recommending Complex Products

If a security is so complicated that even some professionals don’t know how it may perform, how can an investor make an informed decision about whether to buy it? That’s the challenge that investors, regulators, and advisers face with so-called complex products.

The Recommending Complex Products course covers complex products and the concerns regulators have about them. The course defines complex products and describes several types, including structured products, principal protected notes, market-linked CDs, leveraged and inverse ETFs, public non-listed REITs, variable annuities, alternative mutual funds, and private placements. The course also describes the risks of these complex products and the responsibilities of brokers and IARs with respect to recommending them to investors.

By the end of the course, you’ll be able to do the following:

- Broadly define a complex product and explain why NASAA describes them as complex, costly, and risky.

- Distinguish between structured products, such as principal protected notes, and other complex products.

- Identify other common complex products, such as leveraged and inverse ETFs, variable annuities, and private placements.

- Describe the main regulatory concerns surrounding complex products and retail investors.

- Demonstrate a broad understanding of the different ethical and regulatory responsibilities of brokers and IARs when making recommendations.

- Briefly outline regulator recommendations, both in general and with respect to specific complex products.

Completing the Recommending Complex Products course gives participants one credit in the Products and Practices category.

About Solomon IAR CE courses

Solomon’s online IAR CE courses are self-paced and accessible on any internet-enabled device. Each course consists of short reading passages followed by quick assessments. This read-and-quiz format facilitates learning and retention.

All Solomon IAR CE courses earn credit towards the Products and Practices or the Ethics and Professional Responsibility categories required by NASAA. Once activated, you have up to 365 days to complete a course. When you finish a course, Solomon reports completion to FINRA, NASAA’s vendor for program tracking.

To learn more about the IAR CE requirement, visit the Solomon IAR CE FAQs page. Explore Solomon’s entire IAR CE course library – purchase individual courses or a membership to the whole library and complete all your IAR CE in one place.

Disclaimer: NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.