Solomon Exam Prep has just released the Solomon Series 52 Audiobook, which is a word-for-word reading of the Solomon Exam Prep Series 52 Study Guide, 5th Edition. This is the first Audiobook for the Series 52 from Solomon. With the Series 52 Audiobook, you have greater flexibility in where and how you study for the Series 52 exam.

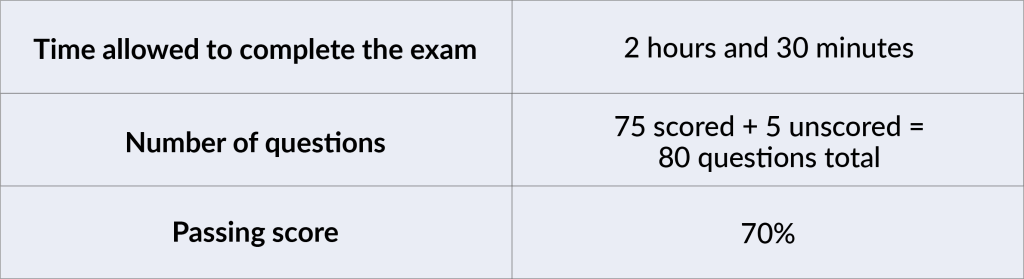

The MSRB Municipal Securities Representative Qualification Exam (Series 52), qualifies you to work in many capacities related to municipal securities such as selling, underwriting, trading, advising, conducting research, and communicating with public investors. Therefore, to prepare for the Series 52 exam, you must study a wide range of municipal securities knowledge.

Since the Audiobook is a verbatim reading of the 5th edition of the comprehensive Solomon Exam Prep Series 52 Study Guide, it provides another effective way to learn the Series 52 material. The audiobook can be used in tandem with the Solomon Series 52 Study Guide and/or Exam Simulator to create a rich study experience benefiting a variety of learners.

The Benefits of Audiobooks

Jeremy Solomon, Solomon Exam Prep President and Co-founder, points out that for people who find reading challenging because of learning disorders, vision impairments, or some other cause, it can be easier and more enjoyable to learn by listening.

Curious about the many benefits of Solomon Audiobooks? Check out our blog post to read more: “Study Tip for Securities Licensing Exams: Learn by Listening.”

Series 52 Study Materials

The 10-hour Solomon Series 52 Audiobook can be purchased individually or as part of a study package, along with the Solomon Series 52 Study Guide and Exam Simulator. The Audiobook is streamable via the Solomon website or free Solomon app for Apple and Android devices. You can also download the tracks to play them offline.

To learn more about Solomon Exam Prep’s Series 52 study materials, including Study Guide, Exam Simulator, and Audiobook, visit the Solomon Series 52 product page.