If you’re considering an entry-level position as an investment banking representative, you’ll need to pass the FINRA Investment Banking Representative Qualification Exam, also known as the Series 79. Although the Series 79 exam is less than half the length it once was (75 questions instead of 175), it’s still known to be a difficult exam. How should you prepare for it?

Solomon Exam Prep has just released the 6th edition of “The Solomon Exam Prep Guide: Series 79 FINRA Investment Banking Representative Qualification Examination.” With this new edition of the Study Guide, professionals who want to become registered Investment Banking Representatives can learn the content they need to know to pass the Series 79 exam. Passing the Series 79, along with the co-requisite Securities Industry Essentials (SIE) Exam, qualifies an individual to advise on and/or facilitate the following:

- Debt and equity offerings (private placement or public offering)

- Mergers and acquisitions

- Tender offers

- Financial restructurings

- Asset sales

- Divestitures or other corporate reorganizations

About the Series 79 Exam

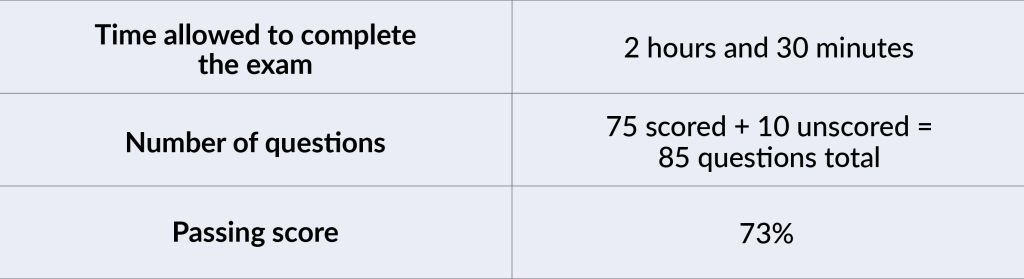

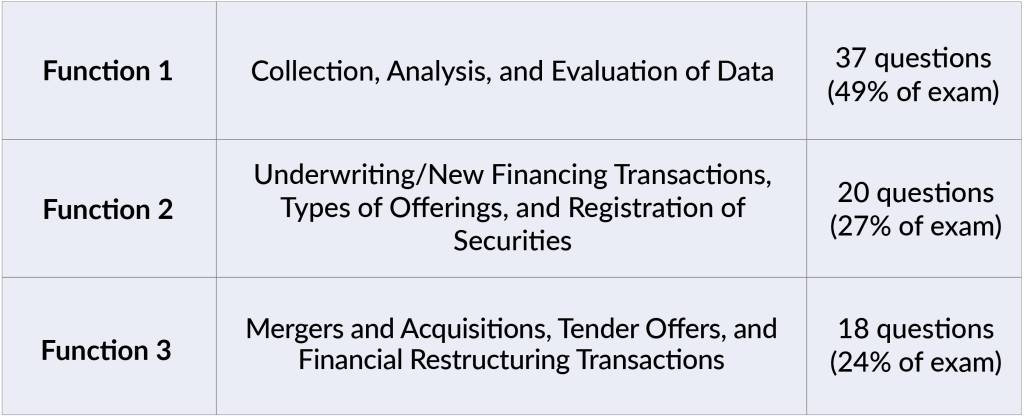

The Series 79 is designed for junior-level bankers, but it’s a challenging exam that requires candidates to master complex subject matter. The Series 79 exam assumes a knowledge of financial accounting and the three basic financial statements: the P&L, the balance sheet, and the cash flow statement. Exam topics are divided into the three major job functions of an investment banking representative:

- Function 1: Collection, Analysis, and Evaluation of Data

- Function 2: Underwriting/New Financing Transaction, Types of Offerings and Registration of Securities

- Function 3: Mergers and Acquisitions, Tender Offers and Financial Restructuring Transaction

To help prepare candidates for this exam, the Solomon Series 79 Study Guide is continually kept up to date to reflect current rules and regulations, and it covers all key exam topics. Charts, graphs, and practice questions throughout the text support learners in understanding and applying important concepts.

What changes with this new edition?

The core content of the Series 79 Study Guide remains the same, but some important changes include:

- Expanded coverage of special purpose acquisition companies (SPACs), an increasingly popular method to fund acquisitions

- Extensive explanation of leveraged buyouts

- Coverage of the SEC’s recently revised list of persons who qualify as accredited investors

- Added material on research analysts throughout discussion of the offering process

- Expanded overview of the registration process

- Discussion of SEC Rule 152

- Expanded coverage of the rules around tender offers and stock buybacks

- Coverage of new rules easing restrictions on testing the waters with potential investors

- New sections on IPO Dutch auctions and tender offer Dutch auctions

- Information about the SEC’s new, higher exempt offering dollar caps

- Updated and expanded explanation of crowdfunding

- Extensive coverage of Regulation Best Interest and the new suitability requirements it imposes on broker-dealers

- Revised and expanded bankruptcy chapter

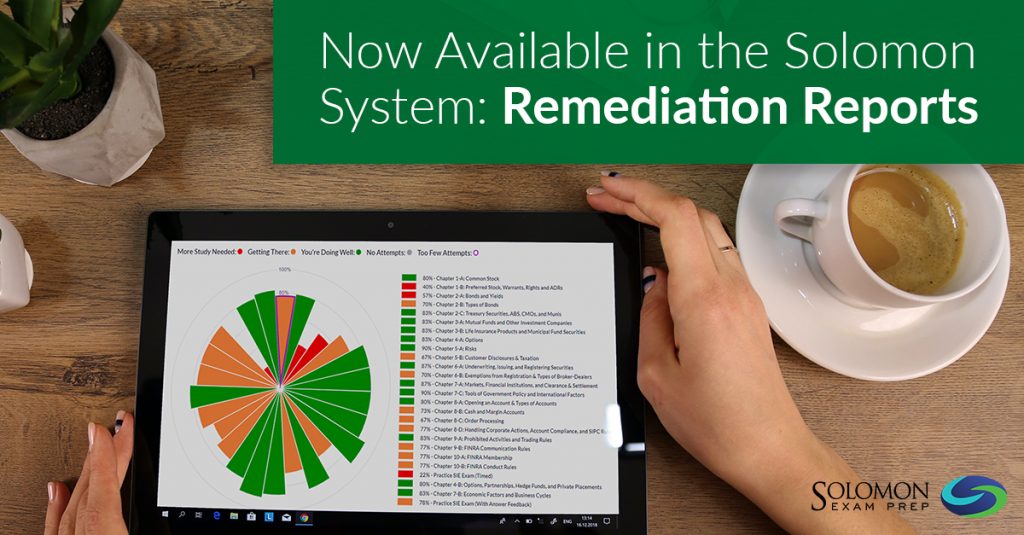

Content updates for this new edition of the Solomon Series 79 Study Guide are also reflected in the Solomon Series 79 Exam Simulator. The Exam Simulator complements the Study Guide with over 1,900 practice questions for the Series 79. Hone, track, and assess your knowledge by taking unlimited chapter quizzes and full exams to practice what you’ve learned.

Series 79 Study Materials

The 6th edition of the Solomon Series 79 Study Guide is available as a digital subscription with a hardcopy upgrade option. You can purchase the Solomon Series 79 Study Guide individually or in a package with supporting Series 79 study products. Customers also have access to free tools and resources, including a study schedule in digital and pdf formats, which helps you master the exam material with maximum efficiency.

To learn more about Solomon Exam Prep’s Series 79 study materials, including Study Guide, Exam Simulator, Audiobook, Video Lecture, and Flashcards, visit the Solomon Series 79 product page.