The answer: only SEC-registered broker-dealers offer SIPC insurance. Crypto platforms like FTX are not SEC-registered broker-dealers.

SIPC stands for Securities Investor Protection Corporation. It was created in 1970 after several brokerage firms went belly up and as a result customers were wiped out.

All brokerage firms that sell stocks or bonds to the public, or that clear securities transactions are required to be members of SIPC. SIPC is a nonprofit corporation owned by its members. Member firms pay into a general insurance fund used to meet customer claims in case of bankruptcy.

If a broker-dealer goes bankrupt, SIPC provides insurance for the assets in investors brokerage accounts. SIPC may also offer insurance to customers from unauthorized trading in, or theft from, their securities accounts.

SIPC members must display an official sign showing their membership. Today that usually means “member SIPC” at the bottom of the brokerage firm’s home page, but if there is a physical office for customers then the requirement sign or plaque in a visible place.

What you need to know about SIPC if you’re taking the SIE exam

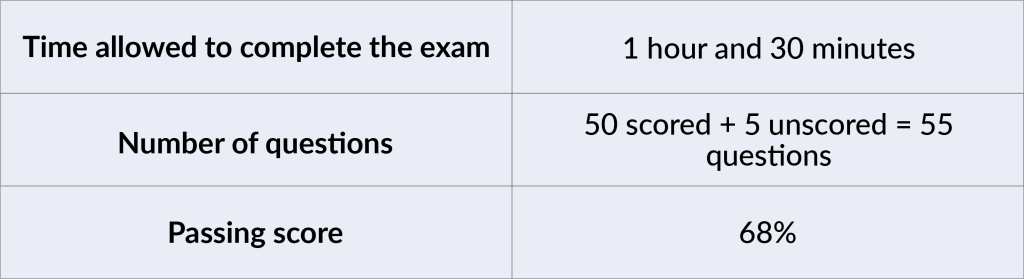

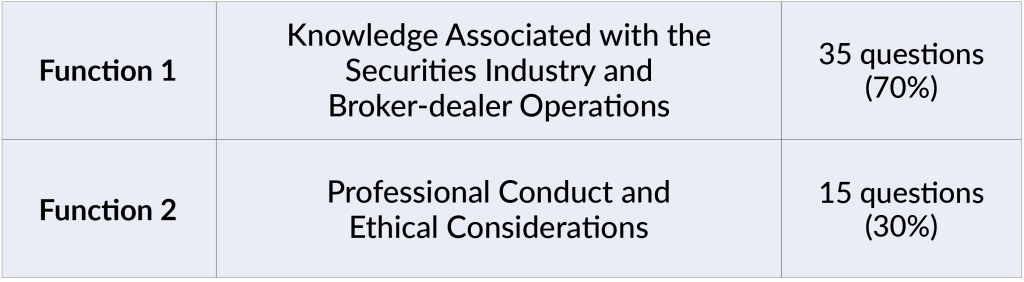

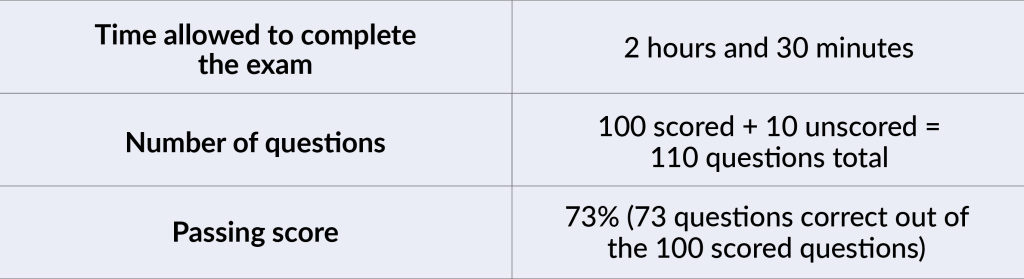

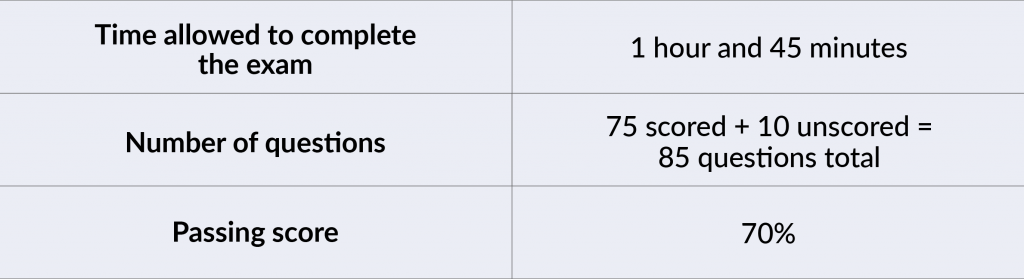

If you’re taking the FINRA Securities Industry Essentials (SIE) exam you need to know the following about SIPC:

SIPC offers up to $500,000 in coverage per customer for securities and cash, with a $250,000 limit for cash only. So if a broker-dealer firm goes bankrupt, then SIPC and the court-appointed Trustee work to return customers’ securities and cash as quickly as possible.

SIPC does not protect against all losses. For example, if the financial markets go down, and the value of customers’ assets declines, SIPC does not cover these type of losses.

If a customer has both a cash and margin account, the accounts are combined for SIPC coverage purposes.

To repeat, SIPC covers a maximum of $500,000 per “separate customer” at a broker-dealer or clearing firm—including up to $250,000 in cash. Total coverage can be higher for multiple accounts owned by the same person if the accounts are considered to be held by separate customers. There are five categories of separate customers defined by SIPC. These categories include (1) individual accounts; (2) joint accounts; (3) accounts held by executors, administrators, and guardians/custodians/conservators (such as UGMA accounts); (4) accounts held by corporations, partnerships, or unincorporated associations; and (5) trust accounts.

So if you are taking the SIE exam, and you get a question that asks if someone has $300,000 in a individual brokerage account, and $200,000 in a joint brokerage account with a spouse, and $400,000 in a trust account, all with the same broker-dealer, how much is covered by SIPC in the event the firm goes bankrupt? Because all three accounts are considered to be held by separate customers, the correct answer is $900,000 or all of the funds.

If your SIE exam asks how much is SIPC covered if the market falls dramatically and the value in an investor’s account drops by half, the correct answer is zero, because SIPC only covers investor losses due to broker-dealer failure, not due to market losses.