The Series 50, also known as the Municipal Advisor Representative Qualification Examination, was developed by the Municipal Securities Rulemaking Board (MSRB) to set professional standards and ensure a basic level of industry knowledge for municipal advisor representatives. Passing the Series 50 exam qualifies you to provide advice about municipal financial products to, or on behalf of, municipal entities. That means you will be able to help municipalities through the process of issuing securities and advise them on how to invest their proceeds.

The registration category, “Municipal Advisor Representative,” was created to comply with the Dodd-Frank Act, which Congress passed in response to the 2008 financial crisis. Municipal advisor firms must have at least one individual who has passed the Series 50 in order to engage in municipal advisory activities.

Whether you have years of professional experience, or you’re just starting out in the industry, the Series 50 can be a challenging exam and requires ample study time. Solomon recommends studying for 60 hours over a four-week period. That might seem daunting, but understanding what the test is like and how to study for it will set you on the path to being well-prepared for exam day.

About the Exam

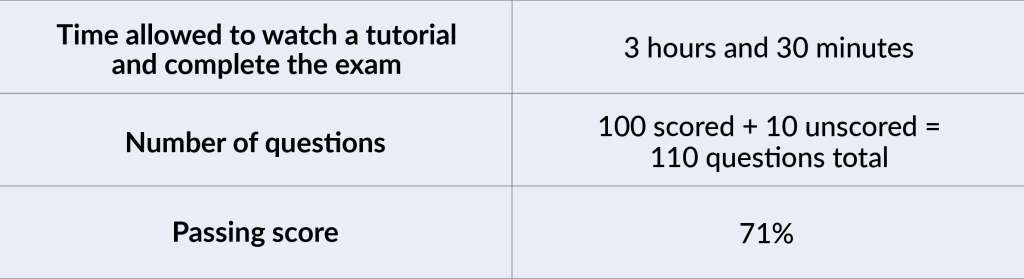

The Series 50 exam consists of 100 scored and 10 un-scored multiple-choice questions covering the five topic areas of the MSRB Series 50 Content Outline. The 10 additional un-scored questions are ones that the exam committee is trying out. These are unidentified and are distributed randomly throughout the exam. Before the test starts, you have 30 minutes to watch a tutorial about the exam’s administration, and this time is included in the total exam time of three and one-half hours.

Note: Scores are rounded down to the next lowest whole number (e.g. 70.9% would be a final score of 70% – not a passing score for the Series 50 exam).

Topics Covered on the Exam

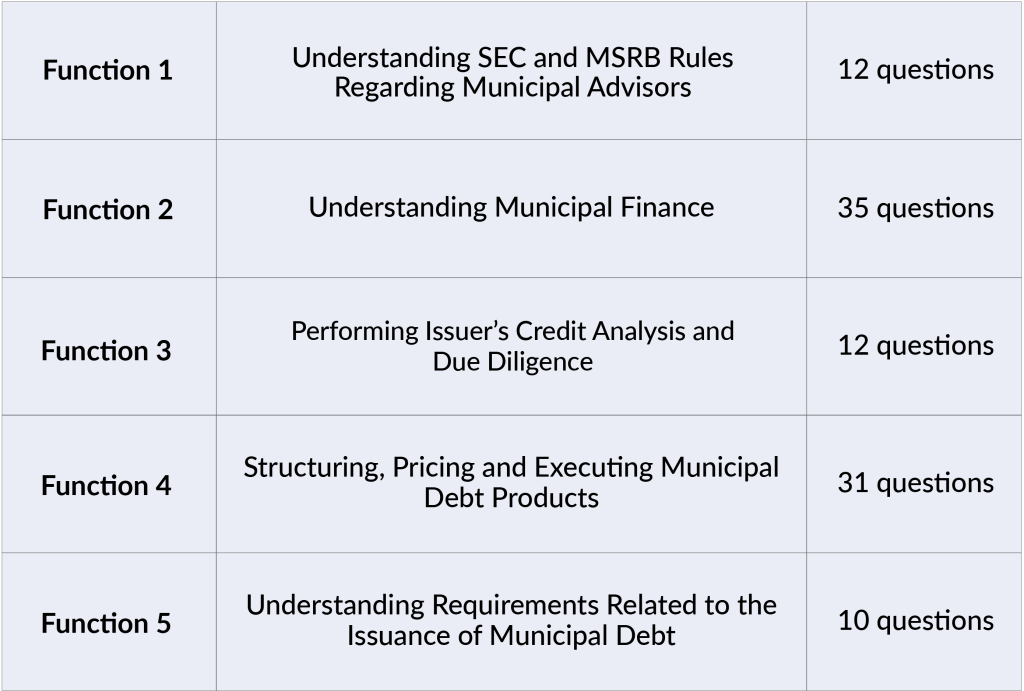

The questions on the Series 50 exam cover the five major job functions of a municipal advisor representative, as determined by the MSRB:

The MSRB updates its exam questions regularly to reflect the most current rules and regulations. Solomon recommends that you print out the current version of the MSRB Series 50 Content Outline and use it in conjunction with the Solomon Series 50 Study Guide. The Content Outline is subject to change without notice, so make sure you have the most recent version.

Question Types on the Exam

The Series 50 exam consists of multiple-choice questions, each with four options. You will see these question structures:

Closed Stem Format:

This item type asks a question and gives four possible answers from which to choose.

Which of the following is true of the MSRB?

-

- The MSRB creates rules that govern issuers of securities.

- The MSRB is composed of 20 members who are knowledgeable about municipal securities.

- The MSRB does not have the power to enforce its own regulations.

- The MSRB was created by the Securities Exchange Act of 1934.

Incomplete Sentence Format:

This kind of question has an incomplete sentence followed by four options that present possible conclusions.

Advisors prohibited from engaging in municipal advisory business under the pay to play rule may qualify for an automatic exemption if:

-

- The advisor discovered the contribution within a reasonable time from the date it was made.

- The contribution did not exceed $250.

- The person who made the contribution obtained its return before the advisor discovered the contribution.

- The advisor has only used three automatic exceptions in the last 12 months.

“EXCEPT” Format:

This type requires you to recognize the one choice that is an exception among the four answer choices presented.

All of the following might be found in the MD&A except:

-

- A summary of the major events of the year for the municipality

- A comparison of the current financial year to the previous one

- An organizational chart of governmental employees

- A discussion of whether the budget was met or exceeded

Complex Multiple-Choice (“Roman Numeral”) Format:

For this question type, you see a question followed by two or more statements identified by Roman numerals. The four answer choices represent combinations of these statements. You must select the combination that best answers the question.

Which of the following are true?

-

- Municipal advisors may, under certain circumstances, act as underwriters.

- Underwriters may, under certain circumstances, act as municipal advisors.

- Municipal advisors may never act as underwriters.

- Underwriters may never act as municipal advisors.

-

- I and IV

- II and III

- I and II

- III and IV

Answers: 1. C 2. B 3. C 4. B

For an even better idea of the possible question types you might encounter on the Series 50 exam, try Solomon Exam Prep’s free Series 50 Sample Quiz.

Taking the Series 50 Exam

The Series 50 exam is administered by FINRA and must be taken at a Prometric test center. Like all qualifying exams in the securities industry, the Series 50 is closed book, which means you are not permitted to bring anything into the exam. The test center will provide you with any materials needed to complete the exam. For instance, the test center will likely provide a whiteboard with markers or scratch paper and a pencil, as well as a basic electronic calculator.

The inspection and sign-in requirements at test centers are stringent, so plan to arrive at least 30 minutes before your scheduled test appointment. Due to COVID-19, you are required to wear a mask the whole time you are at the test center. Solomon recommends taking timed practice exams in the Series 50 Exam Simulator while wearing a mask to get used to this added discomfort.

Test-Taking Tips

When taking the exam, it helps to keep some test-taking strategies in mind. Try not to spend too long on one question—this may cause you to run out of time and not get to other questions you know. If you don’t know the answer to a question, guess at the answer and “flag” it. There is no penalty for guessing, so it is beneficial to answer every question.

After you have finished all the questions, you can come back to any flagged questions. Not only does this strategy allow you to efficiently answer the ones you know, but it can also help because you might learn something later in the exam that may help you answer an earlier question. Just remember to save enough time to return to the questions you didn’t answer. However, it is not a good idea to simply skip all of the difficult questions with the intention of answering them later. You should make a serious effort to answer each question before moving on to the next one, as your thoughts are often clearer early on in the exam-taking process than they will be later.

How to Study for the Series 50 Exam

Follow Solomon Exam Prep’s proven study system:

-

- Read and understand. Read the Solomon Study Guide, carefully. The Series 50 is a knowledge test, not an IQ test. Many students read the Study Guide two or three times before taking the exam. To increase your ability to focus while reading, or as an alternative to reading, listen to the Series 50 Audiobook, which is a word-for-word reading of the Study Guide.

- Answer practice questions in the Exam Simulator. When you’re done with a chapter in the Study Guide, take 4–6 chapter quizzes in the Solomon Exam Simulator. Use these quizzes to give yourself practice and to find out what you need to study more. Make sure you read and understand the question rationales. When you’re finished reading the entire Study Guide, review your handwritten notes once more. Then, and only then, start taking full practice exams in the Exam Simulator. Aim to pass at least six full practice exams and try to get your average score to at least an 80%; when you reach that point, you are probably ready to sit for the Series 50 exam.

Use these effective study strategies:

-

- Take handwritten notes. As you read the Study Guide, take handwritten notes and review your notes every day for 10 to 15 minutes. Studies show that the act of taking handwritten notes in your own words and then reviewing them strengthens learning and memory.

- Make flashcards. Making your own flashcards is another powerful and proven method to reinforce memory and strengthen learning.

- Research. Research anything you do not understand. Curiosity = learning. Students who take responsibility for their own learning by researching anything they do not understand get a deeper understanding of the subject matter and are much more likely to pass.

- Become the teacher. Studies show that explaining what you are learning greatly increases your understanding of the material. Ask someone in your life to listen and ask questions. If you don’t have anyone, explain it to yourself. Studies show that helps almost as much as explaining to an actual person (see Solomon’s previous blog post to learn more about this strategy!).

Take advantage of Solomon’s supplemental tools and resources:

-

- Use all the resources. The Series 50 Resources folder in your Solomon student account has helpful study tools, including documents that summarize important exam concepts. There is also a detailed study schedule that you can print out – or use the online study schedule and check off tasks as you complete them.

- Watch the Video Lecture. This provides a helpful review of the key concepts in each chapter after reading the Solomon Study Guide. Take notes to help yourself stay focused.

-

Good practices while studying:

- Take regular breaks. Studies show that if you are studying for an exam, taking regular walks in a park or natural setting significantly improves scores. Walks in urban areas or among people did not improve test scores.

- Get enough sleep during the period when you are studying. Sleep consolidates learning into memory, studies show. Be good to yourself while you are studying for the Series 50: exercise, eat well, and avoid activities that will hurt your ability to get a good night’s sleep.

You can pass the MSRB Series 50 Exam! It just takes focus and determination. Solomon Exam Prep is here to support you on your path to becoming a municipal advisor representative.

Explore all Solomon Exam Prep Series 50 study materials, including the Study Guide, Exam Simulator, Audiobook, and Video Lecture.

Looking for more support as you prepare for the Series 50 exam? Solomon offers Live Web Classes for the Series 50.

For more helpful securities exam-related content, study tips, industry updates, and promotional offers, join the Solomon email list. Just click the button below: