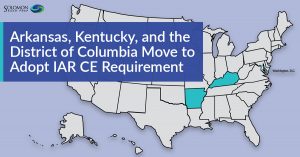

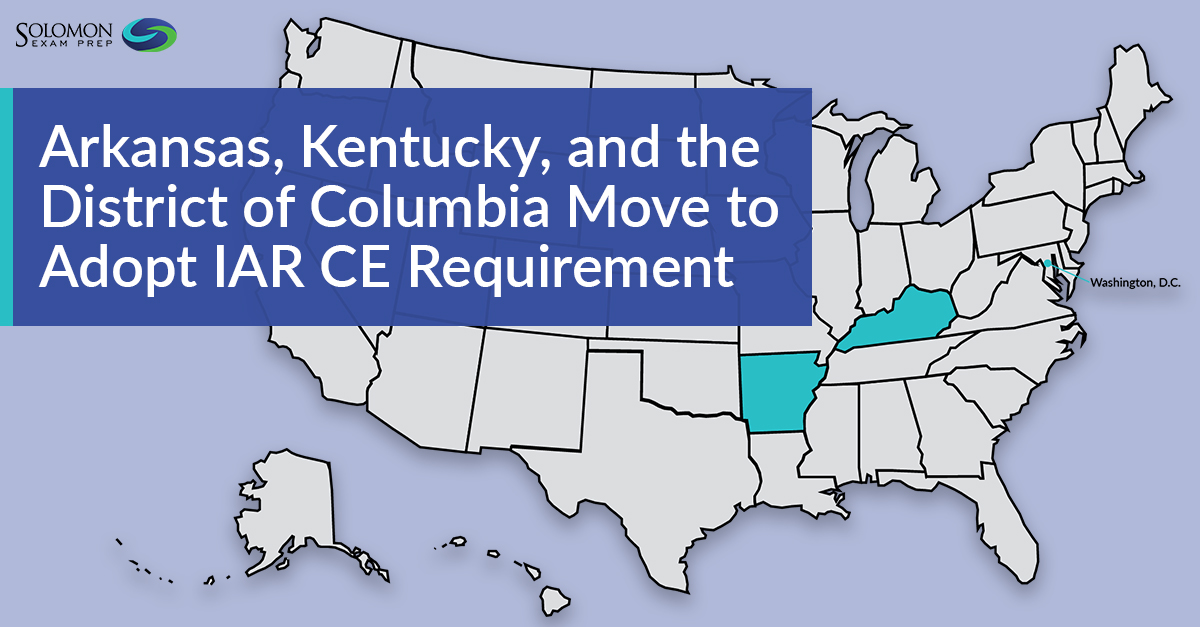

Arkansas is the latest jurisdiction to finalize adoption of NASAA’s new investment adviser representative continuing education (IAR CE) requirement. The CE requirement will go into effect for IARs registered in Arkansas on January 1, 2023. Kentucky, Michigan, Oklahoma, Washington, D.C., and Wisconsin will also begin implementing the requirement in 2023.

The IAR CE requirement went into effect in 2022 in Maryland, Mississippi, and Vermont. As a result, IARs registered in any of these states must complete CE by the end of this year.

Nevada and Rhode Island are also planning to adopt the IAR CE requirement. If these states finalize adoption by the end of 2022, then the requirement will begin in 2023.

According to the NASAA model rule, IARs registered in jurisdictions that have adopted the CE requirement must complete 12 credits of CE each year. The requirement applies to both state-registered and federal-registered investment advisers. Six of the 12 credits must be in the Products and Practices category. The other six credits must be in the Ethics and Professional Responsibility category, with at least three of these being Ethics.

To fulfill the IAR CE requirement, courses must be approved by NASAA. Solomon Exam Prep is a NASAA-approved CE provider, and all courses in the Solomon IAR CE course library offer credit towards the CE requirement. Explore Solomon’s IAR CE courses.

For more information about IAR CE, visit the Solomon IAR CE FAQs or NASAA’s IAR CE FAQs.

Disclaimer: NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.