What is the Series 51 exam?

The Series 51, also called the Municipal Fund Securities Limited Principal Exam, is a Municipal Securities Rulemaking Board (MSRB) exam. The MSRB is a self-regulatory organization that establishes rules for municipal securities dealers and municipal advisors. Municipal securities dealers are required to designate principals to supervise their business and associated persons. To work as a principal in this capacity, you must pass either the Series 53 or Series 51 exam.

The Series 51 was created for principals who don’t otherwise deal in municipal securities and haven’t passed the Series 53. Passing the Series 51 exam qualifies you to oversee the municipal fund securities activities of a broker, dealer, or municipal securities dealer. Note that this is limited to municipal fund securities, whereas the Series 53 allows you oversee activities for all municipal securities. Therefore, the Series 51 is shorter than the Series 53 (60 questions vs 100) and focused on 529 college savings plans, local government investment pools, ABLE plans, and other funds created by a state or municipality.

The Series 51 permits you to manage, direct, and supervise any of the following activities:

-

- Underwriting, trading, and selling municipal fund securities

- Offering financial advice and consultant services to issuers of municipal fund securities

- Communicating with customers about any of the activities above

- Maintaining records related to any of the activities above

- Training of principals and representatives

- Processing, clearing, and safekeeping of municipal fund securities

With a Series 51 license, you may also manage individuals who work in multiple capacities relating to municipal fund securities, including underwriting, sales, trading, advising, and consulting with issuers of municipal fund securities.

Am I eligible to take the Series 51?

To take the Series 51 exam, you must be sponsored by your firm. You must also pass the corequisite Series 24 or Series 26 exam to obtain the Series 51 qualification.

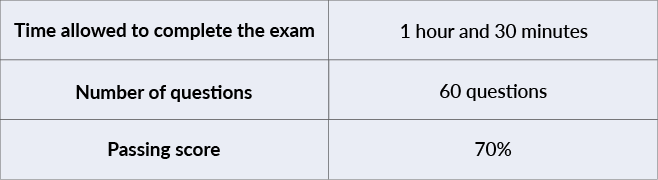

About the Exam

The Series 51 exam consists of 60 multiple-choice questions that are worth one point each. You have one and a half hours to complete the exam, and you must score 70% or higher to pass.

Note: Scores are rounded down to the next lowest whole number (e.g. 69.9% would be a final score of 69%–not a passing score for the Series 51 exam).

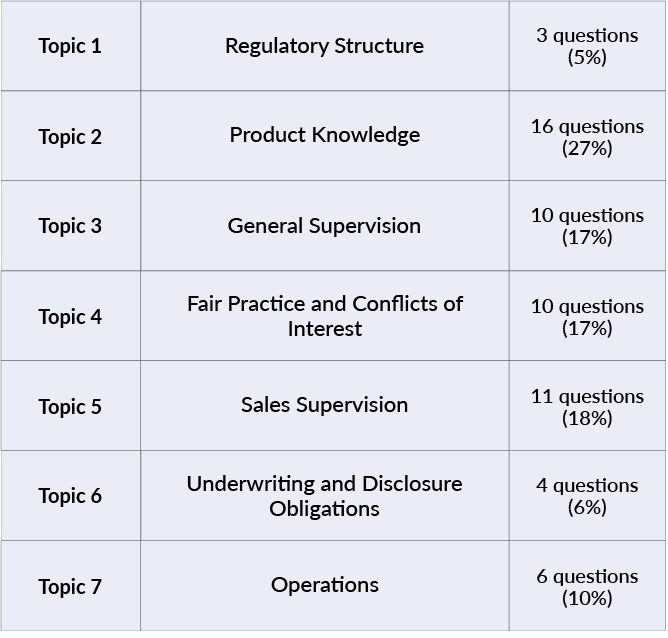

Topics Covered on the Exam

The Series 51 exam measures your knowledge of MSRB rules, rule interpretations, and federal statutory provisions applicable to allowed activities. It also measures your ability to apply these rules and interpretations to given situations in the context of municipal fund securities activities.

The Series 51 exam covers the seven areas of the MSRB Series 51 Content Outline:

The MSRB updates its exam questions regularly to reflect the most current rules and market practices. Solomon recommends that you print out the current version of the MSRB Series 51 Content Outline and use it in conjunction with the Solomon Series 51 Study Guide. The Content Outline is subject to change without notice, so make sure you have the most recent version.

Series 51 Example Questions

The Series 51 exam consists of multiple-choice questions, each with four options. You may see the following question structures. However, keep in mind that these sample questions don’t necessarily represent the difficulty level or subjects covered in the exam.

Closed Stem Format:

This item type asks a question and gives four possible answers to choose from.

For SIPC coverage purposes, which of the following people would have their multiple accounts combined?

-

- Joe, who has an individual account and a joint account with his wife

- Jane, who has a cash account and a margin account in her name

- Jack, who has an UGMA account for his daughter, a trust account for his son, and an individual account

- Joan, who has a partnership account for her business, an individual account, and an UTMA account for her niece

Open Stem Format:

This kind of question has an incomplete sentence followed by four possible conclusions.

Municipal fund securities are distinguished from mutual funds by their:

-

- Sellers

- Issuers

- Investors

- Underlying investments

“Except” (or “Not”) Format:

This type requires an answer that is incorrect or is an exception among the four answer choices.

For a 529 plan, all of the following are qualified education expenses except:

-

- Tuition

- Services for special needs students

- Books

- Room and board for all students

Complex Multiple-Choice (“Roman Numeral”) Format:

For this question type, you see a question followed by two or more statements identified by Roman numerals. The four answer choices represent combinations of these statements. You must select the combination that best answers the question.

Arkansas issues a 529 plan to Firm A. Firm A is in a selling agreement with Firm B. Firm B utilizes other firms to sell the plan. Which of the following are true?

-

- Firm A is a selling dealer.

- Firm B is a selling dealer.

- Firm A is a primary distributor.

- Firm B is a primary distributor.

-

-

- I and III

- I and IV

- II and IV

- II and III

-

- Answers: 1. B 2. B 3. D. 4. D

For more Series 51 practice questions, try a free sample of the Solomon Exam Prep Series 51 Exam Simulator. You’ll receive instant feedback on each question with a robust explanation of the correct answer.

Taking the Series 51 Exam

FINRA administers the Series 51 exam, and you must take it at a Prometric test center via computer. Like all securities industry exams, the Series 51 is closed-book. The testing center will provide you with any materials you need to take the exam, such as a four-function calculator, erasable note board, dry-erase markers, and noise-cancelling headphones. The inspection and sign-in requirements at testing centers are stringent, so arrive at least 30 minutes before your appointment.

Test-Taking Tips

Here are some basic test-taking strategies to remember when taking your exam. Avoid lingering too long on any one question—this could cause you to run out of time and not get to other questions you know. If you’re not sure about a question, take your best guess and mark it for review. There’s no penalty for guessing, so try to answer every question.

After you’ve answered all the questions, you can go back to any questions you flagged for review. This strategy allows you to efficiently answer the ones you know. You might also learn something later in the exam that helps you answer an earlier question. Just remember to factor in some time to return to the questions you flagged. However, don’t simply skip all of the difficult questions with the plan to answer them later. Instead, make a sincere effort to answer each question before moving on to the next one because your mind is fresher earlier on during the exam.

How to Study for the Series 51 Exam

Follow Solomon Exam Prep’s proven study system:

-

- Read and understand. Read the Solomon Study Guide, carefully. Many students read the Study Guide two or three times before taking the exam.

- Take chapter quizzes in the Exam Simulator. When you finish reading a chapter in the Study Guide, take 4–6 chapter quizzes in the Exam Simulator. Use these quizzes to give yourself practice and to find out what you need to study more. Make sure you read and understand the question rationales.

- Take full practice exams in the Exam Simulator. When you’ve finished reading the entire Study Guide, review your handwritten notes once more. Finally, start taking full practice exams in the Exam Simulator. Aim to pass at least six full practice exams and try to get your average score to at least 80%. When you reach that point, you’re probably ready to sit for the Series 51 exam.

Use these effective study strategies:

-

- Take handwritten notes. As you read the Study Guide, take handwritten notes and review your notes every day for 10–15 minutes. Studies show that taking handwritten notes in your own words and then reviewing them strengthens learning and memory.

- Make flashcards. Making your own flashcards is another proven method to reinforce memory and strengthen learning.

- Research. Research anything you don’t understand. Curiosity = learning. Students who take responsibility for their own learning by researching anything they don’t understand get a deeper understanding of the subject matter and are much more likely to pass.

- Become the teacher. Studies show that explaining what you’re learning greatly increases your understanding of the material. Ask someone in your life to listen and ask questions, or explain it out loud to yourself. Studies show this helps almost as much as explaining to an actual person (see Solomon’s blog post to learn more about this strategy!).

Take advantage of Solomon’s supplemental tools and resources:

-

- Use all the resources. The Series 51 Resources folder in your Solomon student account has helpful study tools, including detailed study schedules that you can print out. Or, use the online study schedule and check off tasks as you complete them.

- Use Ask the Professor. If you have a content-related question, click the Ask the Professor button in your account dashboard and get personalized help from a Solomon professor

-

Good practices while studying:

- Take regular breaks. Studies show that if you’re studying for an exam, taking regular walks in a park or natural setting significantly improves scores. Walks in urban areas or among people did not improve test scores.

- Get enough sleep. Sleep consolidates learning into memory, studies show. Be good to yourself while you’re studying for the Series 51: exercise, eat well, and avoid activities that will hurt your ability to get a good night’s sleep.

You can pass the MSRB Series 51 exam! It just takes focus and determination. Solomon Exam Prep is here to support you on your path to becoming a Municipal Fund Securities Limited Principal..

Explore all Solomon Series 51 exam prep, including the Study Guide, Exam Simulator, and Audiobook.

And join the Solomon email list to hear about new product releases, industry news, and more! Just click the button below: