Solomon Exam Prep and the State College of Florida (SCF) have expanded their partnership to offer exam prep courses for a total of six securities exams. Solomon study programs are being used in courses for the FINRA SIE, Series 6, and Series 7 exams, as well as the NASAA Series 63, 65, and 66 exams.

About the Courses

Offered through SCF Workforce Development, the courses are 100% online and self-paced, so students can easily fit study time into their individual schedules. Anyone 18 years or older can register for the courses. Each course includes 180-day access to the Solomon Total Study Package, which consists of these Solomon digital materials:

- Study Guide

- Exam Simulator

- Audiobook

- Video Lecture

- Flashcards

In addition to these study materials, all courses provide free Solomon tools and resources to give students the best chance at passing their exams. These include Solomon Study Schedules in digital and pdf formats, individual instructor support via Ask the Professor, and Solomon Pass Probability™, an innovative feature that predicts a student’s readiness to take the exam.

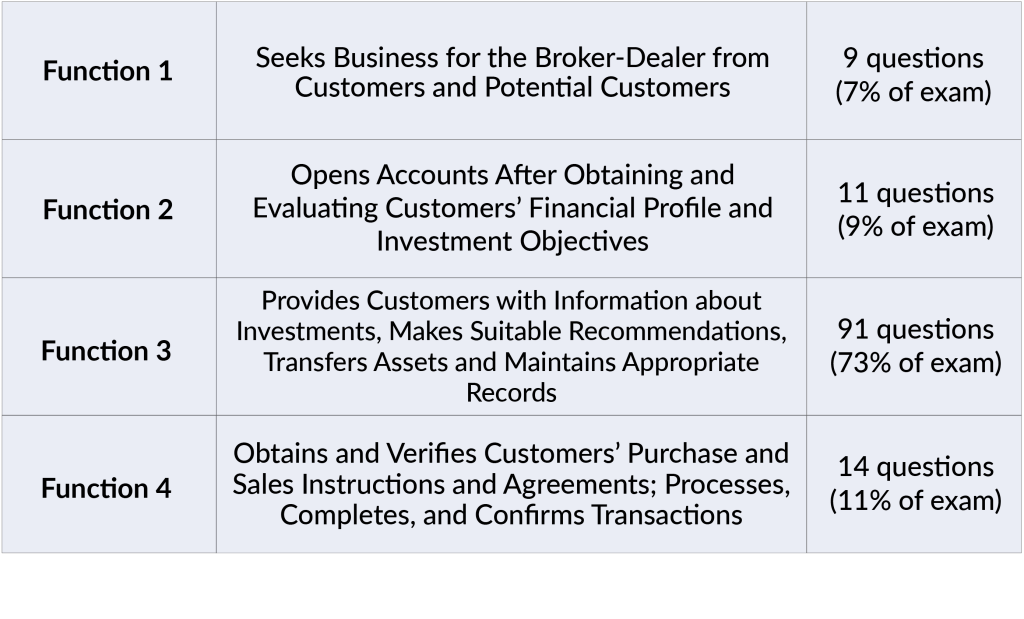

About the Exams

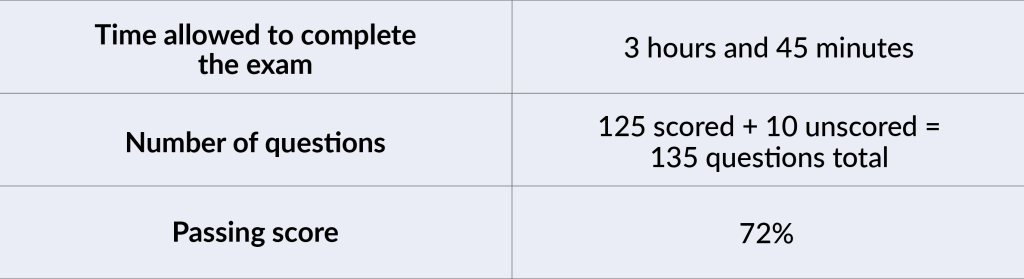

Passing the Securities Industry Essentials (SIE) Exam is the foundational requirement for many careers in the securities industry. The SIE covers basic or “essential” securities industry knowledge. In addition to passing the SIE, individuals must also pass specialized representative-level exams (such as the Series 6 and Series 7) to be permitted to work in specific job roles. These exams “top-off” your knowledge of the industry with more in-depth information. Most people take the SIE first and then take one or more representative-level exams.

Partner with Solomon Exam Prep

Solomon Exam Prep partners with dozens of colleges and universities to bring securities exam prep to students across the country. The Solomon learning system works equally well for in-person, hybrid, and online courses.

Join institutions such as State College of Florida, Elon University, Florida Memorial University, Pepperdine University, the University of North Carolina at Pembroke, Claflin University, University of Delaware, Adelphi University, University of Nebraska-Omaha, Seton Hall University, Ohio Dominican University, Georgetown University, Widener University, and University of Dallas in partnering with Solomon.

To learn more about the ways colleges and universities can partner with Solomon, contact Beth Hamilton, Higher Education Sales Manager, at beth@solomonexamprep.com or 503-601-0212.