Tips For Passing Your Next SIE Exam Attempt

Try to redouble your efforts and study hard for the next 30 days so you can retake the SIE exam as soon as possible. The longer you wait, the more likely it is that the material you’ve learned will slip away. You also risk giving up completely if you wait too long to get back on track.

In addition, FINRA does change its exam questions. Therefore, the sooner you retake an exam, the higher chance you have of facing some of the same or similar questions. Write down everything you can remember about the exam. Then, use your experience to your advantage and focus your studying on what you know was on the exam and may well be again.

How to re-study for your securities exam

Needless to say, you should carefully consider how to approach preparing for a second attempt at the SIE or another securities exam. It shouldn’t be done in one weekend of cramming. The SIE is a knowledge test. Learning (and passing) comes from layering the knowledge and building mental connections that you can use when you take the exam—and beyond. As with any knowledge test, the more effort you put into studying, the better your chance of success. That said, your re-study strategy will depend to some extent on your score on the first exam attempt.

If you didn’t have a strong performance on the exam:

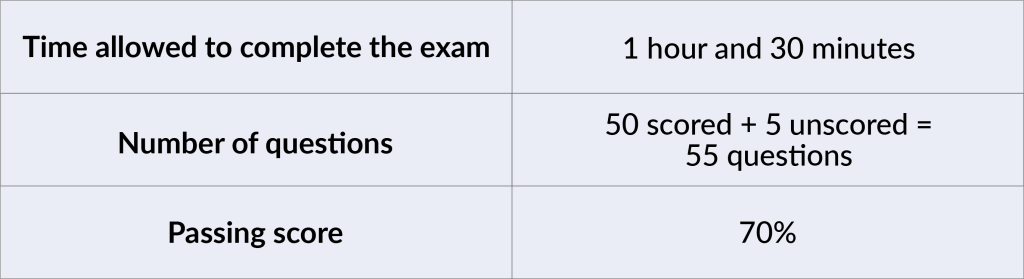

The minimum passing score for the SIE exam is 70%. If you scored below 60% on your first try, you may want to approach studying as if for the first time. If you’re using Solomon SIE study materials, use a pre-set Solomon study schedule and follow it every day. Doing this will greatly increase your chance of passing. If you don’t follow a pre-set Solomon schedule, we recommend the following plan at a minimum:

- Read the SIE Study Guide. Not reading the Study Guide is the number one reason people fail their exam. Take notes as you read and review your notes regularly. If you don’t understand something, try to explain it to someone else or to yourself out loud. This “be the teacher” technique will help you master the material. Read Solomon’s article about this technique.

- Quiz yourself with SIE practice questions in the Exam Simulator. After reading each chapter of the Study Guide, take up to six sub-chapter quizzes per sub-chapter in the Solomon Exam Simulator. The quizzes are for learning more than they are for assessment, so don’t be alarmed if your quiz scores are low and do not get bogged down by taking more than six sub-chapter quizzes per chapter.

- Assess your knowledge with SIE practice exams in the Exam Simulator. Once you’ve read the entire Study Guide, at least once, then take at least six full practice exams in the Exam Simulator. Aim to get your Solomon Pass Probability™ score to at least 75% before you take the SIE exam again. If your Pass Probability™ is below 75%, review your results charts in the Exam Simulator and re-study the chapters and topics where you’re not doing well.

If you almost passed:

What if you were very close to passing the SIE exam on your first attempt, scoring close to 70%? In this case, you probably don’t need to start studying from scratch. Look at your exam score report and focus your studies on the exam sections that you didn’t perform strongly in. Also, if you’ve taken at least five full SIE practice exams in the Solomon Exam Simulator, look at your Exam Results charts to see if there are any sections that you’re scoring under 75% in. Focusing on these weaker sections, take the following steps:

- Reread parts of the SIE Study Guide. Revisit your weaker sections in the Study Guide and/or review the notes you took when you read it the first time.

- Quiz yourself with SIE practice questions in the Exam Simulator. Take three more quizzes on your weaker sub-chapters. Remember, the purpose of taking quizzes is to strengthen your learning, so try not to focus too much on your quiz scores. You can even take the sub-chapter quizzes open book!

- Watch the SIE Video Lecture. If you have the Solomon Video Lecture, watch the lecture on these weaker chapters as well. The Video Lecture provides a helpful overview of the key concepts for each chapter. You can download the Video Lecture slides and print them out to take notes while you watch.

- Assess your knowledge with SIE practice exams in the Exam Simulator. The Exam Simulator is a tool to help you apply the concepts you’ve learned, but it’s also a diagnostic tool for gauging your readiness to pass the exam. After you’ve done all the previous steps for the chapters you needed to revisit, you’re ready to take five more full practice exams in the Exam Simulator. When your Solomon Pass Probability™ score is 75% or above, you should be ready to sit for the SIE exam again.

You can do it.

Don’t let this temporary setback put the brakes on your career goals! Everyone can pass the SIE exam, no matter what their educational background or career experience is. You just need to follow an effective study plan with quality study materials. You can do it!

Visit the Solomon SIE page for more information about Solomon study materials for the SIE exam. And try Solomon’s free, 75-question SIE practice test to gauge your knowledge and sample the industry-leading Solomon Exam Simulator.