What is the Series 22 exam?

The Series 22, also called the Direct Participation Programs Representative Exam, is a FINRA (Financial Industry Regulatory Authority) exam. FINRA is an independent, self-regulatory organization that creates and enforces rules for registered broker-dealer firms and their representatives. FINRA is also responsible for administering securities licensing exams, such as the Securities Industry Essentials (SIE) exam, Series 7 exam, Series 22 exam, and many more.

The Series 22 exam measures the knowledge of entry-level registered representatives to perform their duties as Direct Participation Programs Representatives. Taking the exam will help you understand your professional responsibilities, including the solicitation, purchase, and sale of limited partnerships, among other products.

What does the Series 22 permit me to do?

Did you know that the Series 22 exam is an easier path to becoming a direct participation program representative than the Series 7? The Series 22 is a shorter exam requiring less study time. Pass it and you’re on your way to being qualified to solicit and sell interests in direct participation programs (DPPs), including real estate, oil and gas, equipment leasing, BDCs, agricultural, and like-kind exchanges.

A DPP is FINRA term for a pass-through entity, such as a limited partnership or S-corp, whose shares indicate ownership, not of an operating company, but of certain physical assets of the company. As a pass-through entity, DPPs can offer tax benefits to investors, but they are not suitable for all investors, and they are not liquid investments.

Other permitted activities and products with a Series 22 license include:

-

- Limited partnerships

- Limited liability companies

- S corporations

Am I eligible to take the Series 22?

You must be employed and sponsored by a FINRA-member firm to take the Series 22 exam.

To obtain the Series 22 qualification, you must also pass the co-requisite Securities Industry Essentials (SIE) exam. Unlike the Series 22 exam, the SIE does not require you to be sponsored by a broker-dealer.

About the Exam

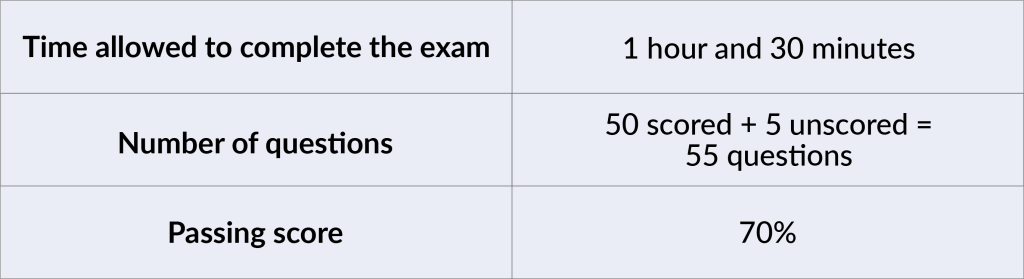

The Series 22 exam consists of 50 scored and five unscored multiple-choice questions. The five unscored questions are experimental questions and appear randomly.

Note: Scores are rounded down to the next lowest whole number (e.g. 69.9% would be a final score of 69%–not a passing score for the Series 22 exam).

Topics Covered on the Exam

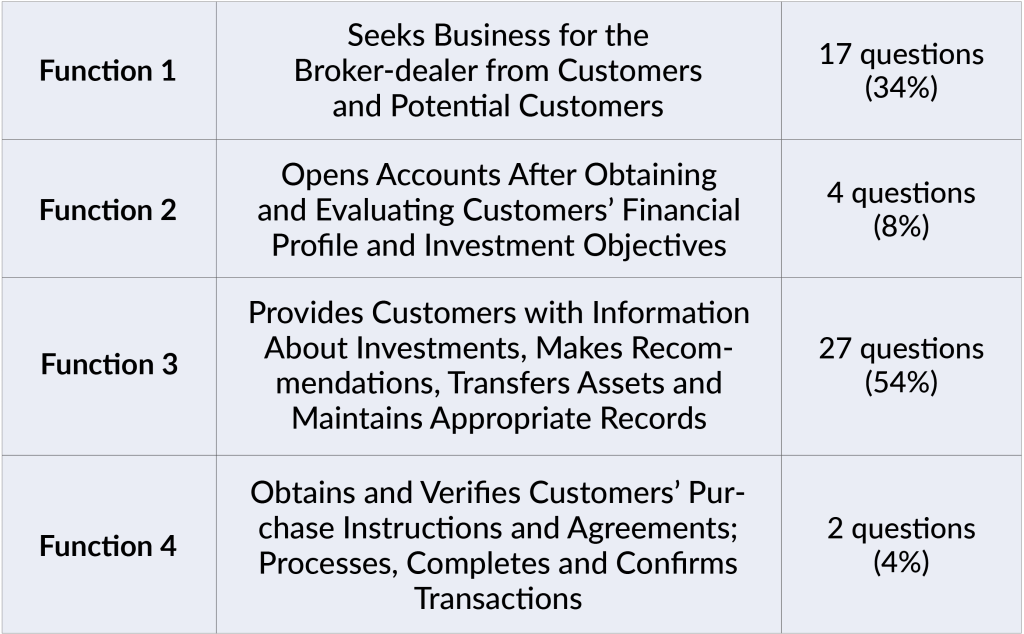

FINRA divides the questions on the Series 22 exam into four areas representing the four major job functions of a Direct Participation Programs Representative. FINRA updates its exam questions regularly to reflect the most current rules and regulations.

Solomon recommends that you print out the current version of the FINRA Series 22 Content Outline and use it in conjunction with the Solomon Series 22 Study Guide. The Content Outline is subject to change without notice, so make sure you have the most recent version.

Series 22 Example Questions

The Series 22 exam consists of multiple-choice questions, each with four options. You may see the following question structures. However, keep in mind that these sample questions don’t necessarily represent the difficulty level or subjects covered in the exam.

Closed Stem Format:

This item type asks a question and gives four possible answers to choose from.

Which of the following could potentially be a DPP?

-

- A corporation

- A REIT

- A company that has issued exchange-traded securities

- An investment company

Open Stem Format:

This kind of question has an incomplete sentence followed by four possible conclusions.

Owners of limited liability companies (LLCs) are considered:

-

- Shareholders

- Members

- Trustees

- Partners

“Except” (or “Not”) Format:

This type requires an answer that is incorrect or is an exception among the four answer choices.

Each of the following can cause an LP to be dissolved before the date specified in its Certificate of Limited Partnership, except:

-

- The only general partner dies.

- The LP declares bankruptcy.

- The only remaining general partners are substitute general partners.

- A majority of limited partners and all general partners agree to early dissolution.

- Answers: 1. A 2. B 3. C

For more Series 22 practice questions, try a free sample of Solomon Exam Prep’s Series 22 Exam Simulator. You’ll receive instant feedback on each question with a robust explanation of the correct answer.

Taking the Series 22 Exam

FINRA administers the Series 22 exam, and you must take it at a Prometric test center. The exam is given via computer. Before the exam, you’ll be able to watch a tutorial on how to take the exam.

Like all qualifying exams in the securities industry, the Series 22 is closed-book, and you’re not allowed to bring anything into the exam. The test center will provide you with any materials you need to complete the exam. For instance, the test center may provide a whiteboard with markers or scratch paper and a pencil, as well as a basic electronic calculator. The inspection and sign-in requirements at test centers are stringent, so plan to arrive at least 30 minutes before your scheduled test appointment.

Test-Taking Tips

When taking the exam, it helps to keep some test-taking strategies in mind. Try not to spend too long on one question—this may cause you to run out of time and not get to other questions you know. If you don’t know the answer to a question, guess at the answer and mark it for review . There’s no penalty for guessing, so it’s beneficial to answer every question.

After you’ve finished all the questions, you can return to any flagged questions. This strategy allows you to efficiently answer the ones you know. You might also learn something later in the exam that helps you answer an earlier question. Just remember to save enough time to return to the questions you didn’t answer. However, it’s not a good idea to simply skip all of the difficult questions with the plan to answer them later. You should make a serious effort to answer each question before moving on to the next one since your thoughts are often clearer earlier on during the exam.

How to Study for the Series 22 Exam

Follow Solomon Exam Prep’s proven study system:

-

- Read and understand. Read the Solomon Study Guide, carefully. Many students read the Study Guide two or three times before taking the exam.

- Take chapter quizzes in the Exam Simulator. When you finish reading a chapter in the Study Guide, take 4–6 chapter quizzes in the Exam Simulator. Use these quizzes to give yourself practice and to find out what you need to study more. Make sure you read and understand the question rationales.

- Take full practice exams in the Exam Simulator. When you’ve finished reading the entire Study Guide, review your handwritten notes once more. Finally, start taking full practice exams in the Exam Simulator. Aim to pass at least six full practice exams and try to get your average score to at least 80%. When you reach that point, you’re probably ready to sit for the Series 22 exam.

Use these effective study strategies:

-

- Take handwritten notes. As you read the Study Guide, take handwritten notes and review your notes every day for 10–15 minutes. Studies show that taking handwritten notes in your own words and then reviewing them strengthens learning and memory.

- Make flashcards. Making your own flashcards is another proven method to reinforce memory and strengthen learning.

- Research. Research anything you don’t understand. Curiosity = learning. Students who take responsibility for their own learning by researching anything they don’t understand get a deeper understanding of the subject matter and are much more likely to pass.

- Become the teacher. Studies show that explaining what you’re learning greatly increases your understanding of the material. Ask someone in your life to listen and ask questions, or explain it out loud to yourself. Studies show this helps almost as much as explaining to an actual person (see Solomon’s blog post to learn more about this strategy!).

Take advantage of Solomon’s supplemental tools and resources:

-

- Use all the resources. The Series 22 Resources folder in your Solomon student account has helpful study tools, including detailed study schedules that you can print out. Or, use the online study schedule and check off tasks as you complete them.

- Use Ask the Professor. If you have a content-related question, click the Ask the Professor button in your account dashboard and get personalized help from a Solomon professor

-

Good practices while studying:

- Take regular breaks. Studies show that if you’re studying for an exam, taking regular walks in a park or natural setting significantly improves scores. Walks in urban areas or among people did not improve test scores.

- Get enough sleep. Sleep consolidates learning into memory, studies show. Be good to yourself while you’re studying for the Series 22: exercise, eat well, and avoid activities that will hurt your ability to get a good night’s sleep.

You can pass the FINRA Series 22 exam! It just takes focus and determination. Solomon Exam Prep is here to support you on your path to becoming a Direct Participation Programs Representative.

Explore all Solomon Series 22 exam prep, including the Study Guide and Exam Simulator.

And join the Solomon email list to hear about new product releases, industry news, and more! Just click the button below: