Photo used in image by [Seventyfour]/stock.adobe.com

If you already have a Municipal Securities Representative (Series 52) license, you might be considering taking the Series 53 exam. The MSRB Municipal Securities Principal Qualification Exam (Series 53) qualifies you to oversee the municipal fund securities activities of a securities firm or bank dealer. You’re also permitted to supervise associates working in multiple capacities related to municipal securities. For this reason, passing the Series 53 exam requires you to know a lot about municipal securities, MSRB rules, customer accounts, municipal securities trading, recordkeeping, suitability, settlement and delivery, federal securities acts, SIPC, and more. How will you learn everything you need to know to pass this challenging exam?

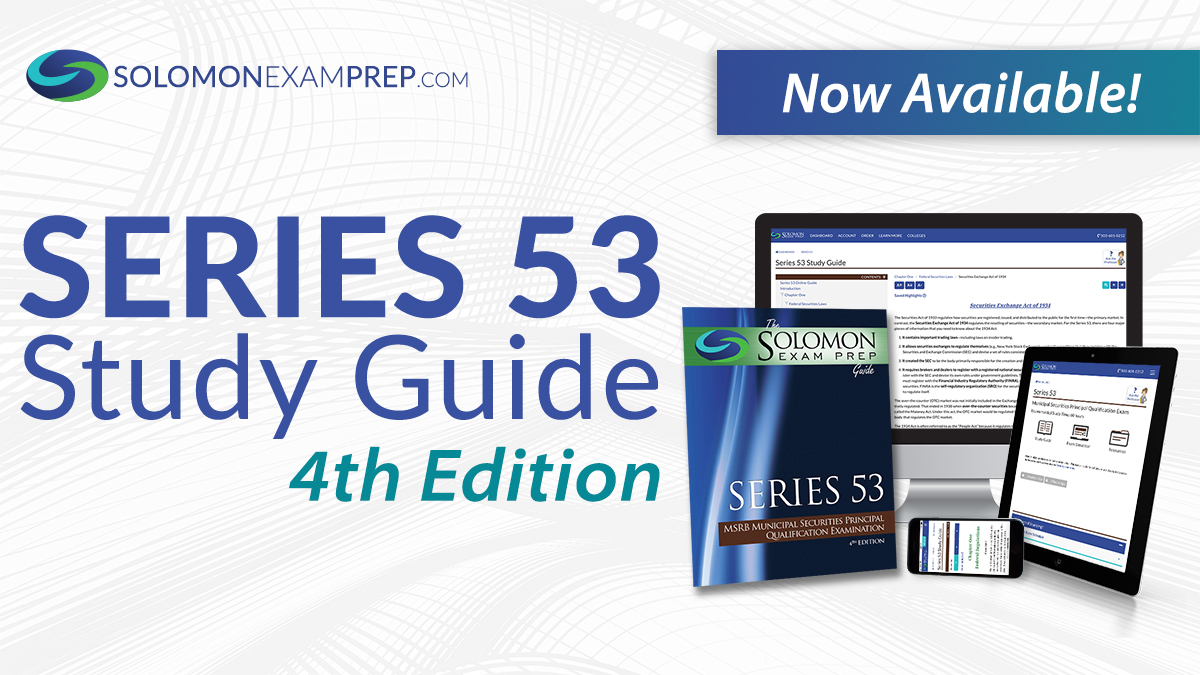

Solomon Exam Prep is excited to announce the release of its first Audiobook for the Series 53 exam. A word-for-word reading of the Solomon Exam Prep Series 53 Study Guide, 4th Edition, the Solomon Series 53 Audiobook gives you increased flexibility in where and how you study for the Series 53 exam.

The Benefits of Audiobooks

If you like to learn by listening, a Solomon Audiobook offers the perfect way to study on the go. Or, play it while you read to help yourself focus and retain even more content. Read this Solomon blog post to learn more about the benefits of studying with audiobooks.

The Series 53 Audiobook is streamable from your Solomon student dashboard or the free Solomon app for Apple and Android devices and includes these helpful features:

- Tracks divided and named by chapter so it’s easy to follow your Solomon study schedule

- Time-stamped sub-sections to quickly jump to specific sections in a chapter

- Simple track downloading option available for offline learning

Series 53 Study Materials

The 9.5-hour Series 53 Audiobook can be purchased individually or as part of the Audio Premium study package, along with the Solomon Series 53 Study Guide and Exam Simulator. To learn more about Solomon Exam Prep’s Series 53 study materials, including Study Guide, Exam Simulator, and Audiobook, visit the Solomon Series 53 product page.