What does the Series 7 exam permit me to do?

The Series 7, also known as the General Securities Representative Qualification Exam, was developed by the Financial Industry Regulatory Authority (FINRA) to assess the skills and competency of entry-level registered representatives as general securities representatives. Passing the Series 7 exam qualifies you to solicit, purchase, and/or sell all securities products, including corporate securities, municipal fund securities, options, direct participation programs, investment company products, and variable contracts. As a result of this broad scope, the Series 7 exam is one of the longest and most challenging securities industry exams. The good news, however, is that you will be permitted to perform an impressive range of activities with a Series 7 license. The following are covered activities and products:

-

- Public offerings and/or private placements of corporate securities (stocks and bonds)

- Rights

- Warrants

- Mutual funds

- Money market funds

- Unit investment trusts (UITs)

- Exchange-traded funds (ETFs)

- Real estate investment trusts (REITs)

- Options on mortgage-backed securities

- Government securities

- Repos and certificates of accrual on government securities

- Direct participation programs (DPPs)

- Venture capital

- Sale of municipal securities

- Hedge funds

Do I need to take any other securities licensing exams?

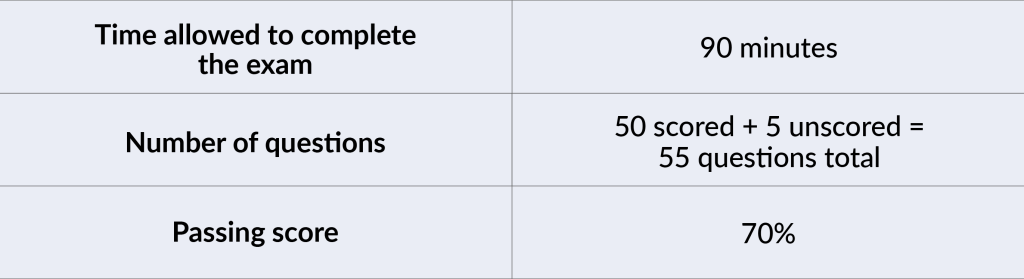

In order to be registered as a general securities representative, you must pass two exams: the Series 7 and the FINRA Securities Industry Essentials (SIE) exam. While the Series 7 requires you to be hired and sponsored by a FINRA-member firm, the SIE does not. Therefore, even though you can technically take them in either order, it makes sense to take the introductory-level SIE exam before taking the Series 7 exam.

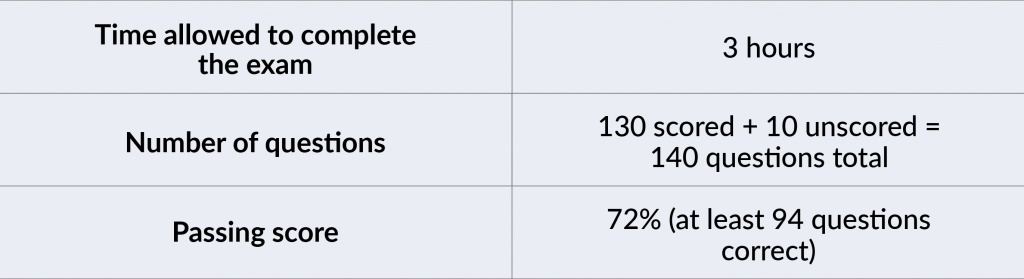

About the Exam

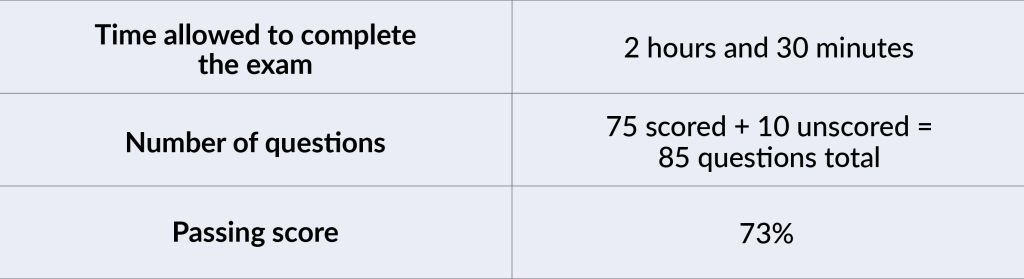

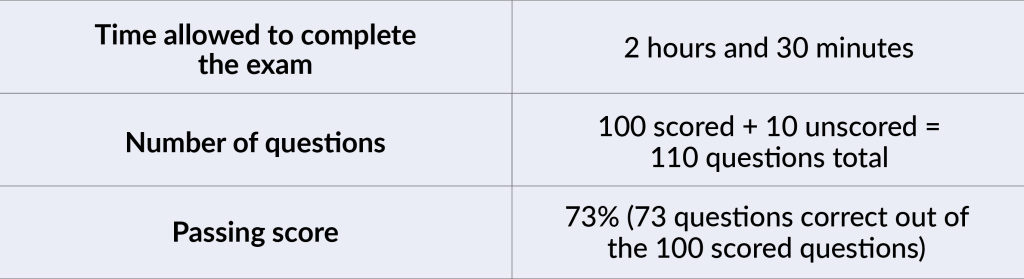

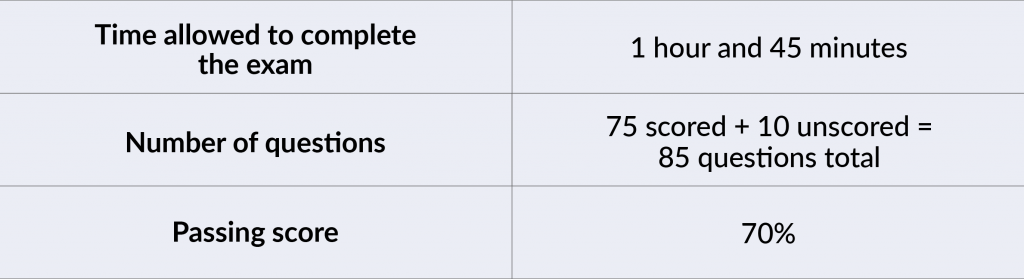

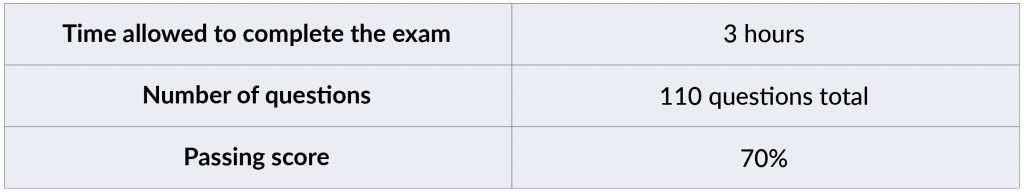

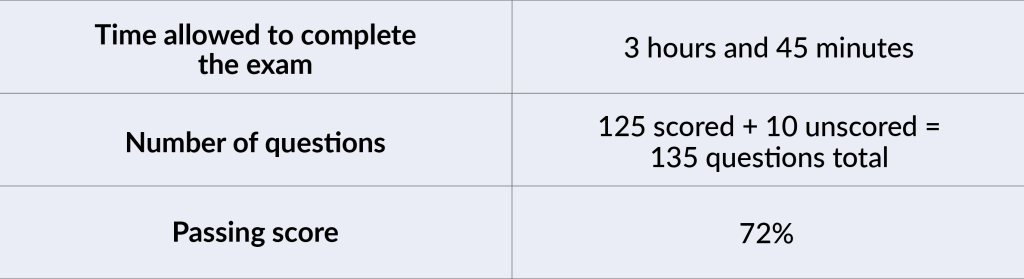

The Series 7 exam consists of 125 scored and 10 un-scored multiple-choice questions covering the four sections of the FINRA Series 7 content outline. The 10 additional un-scored questions are ones that the exam committee is trying out. These are unidentified and are distributed randomly throughout the exam.

Note: Scores are rounded down to the next lowest whole number (e.g. 71.9% would be a final score of 71% – not a passing score for the Series 7 exam).

Topics Covered on the Exam

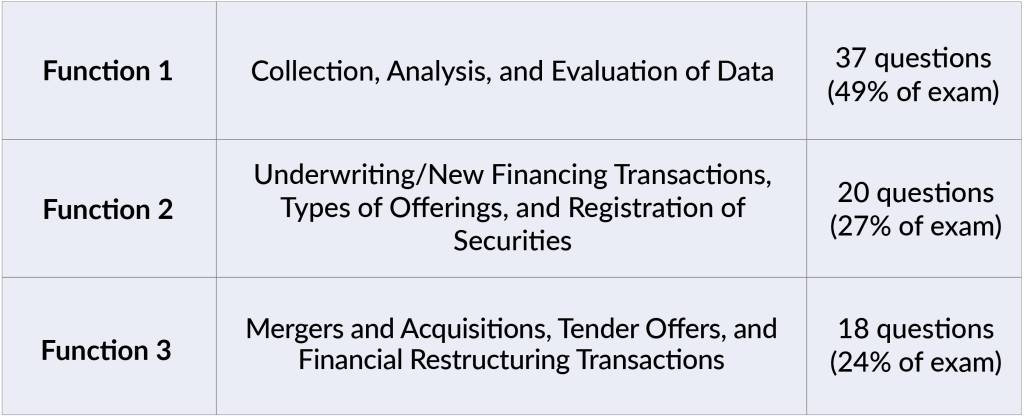

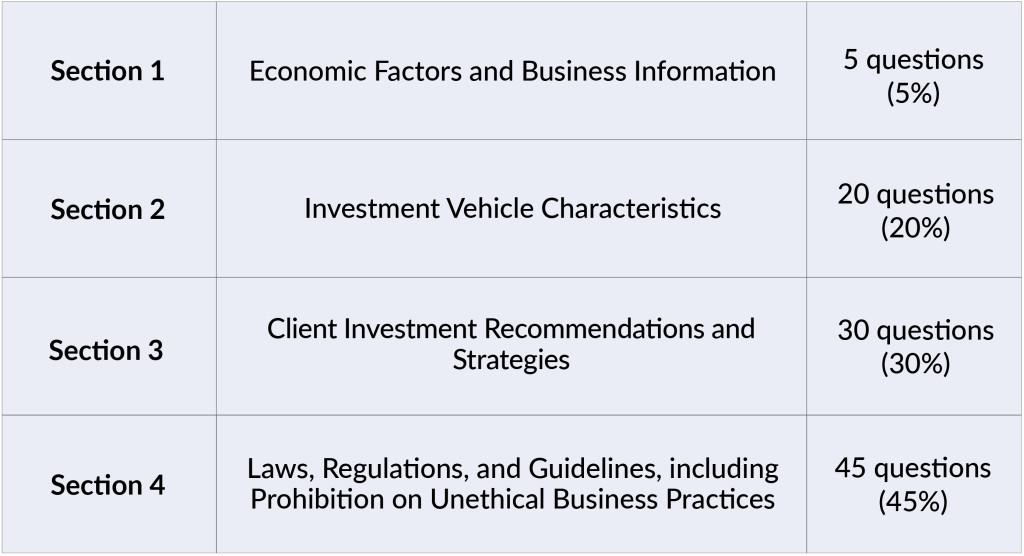

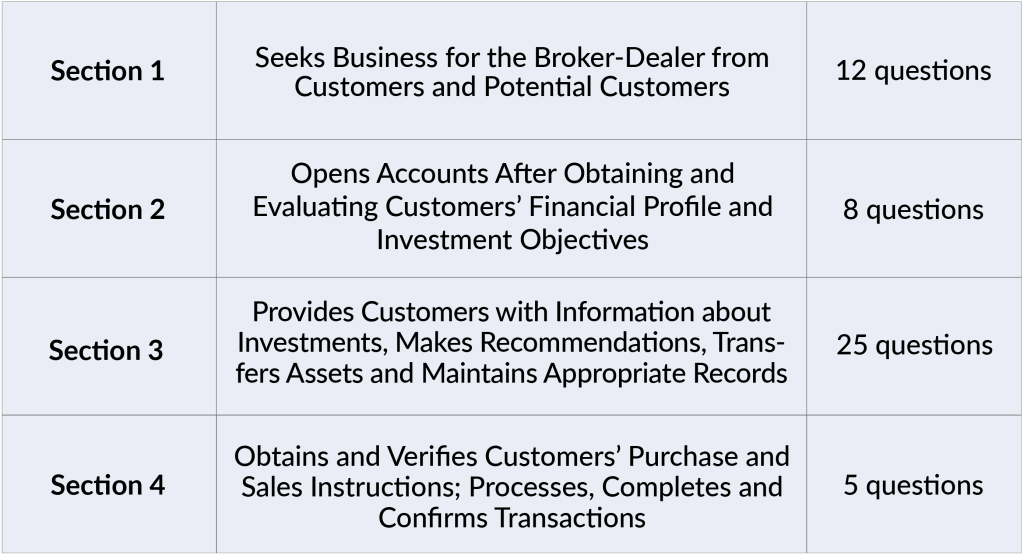

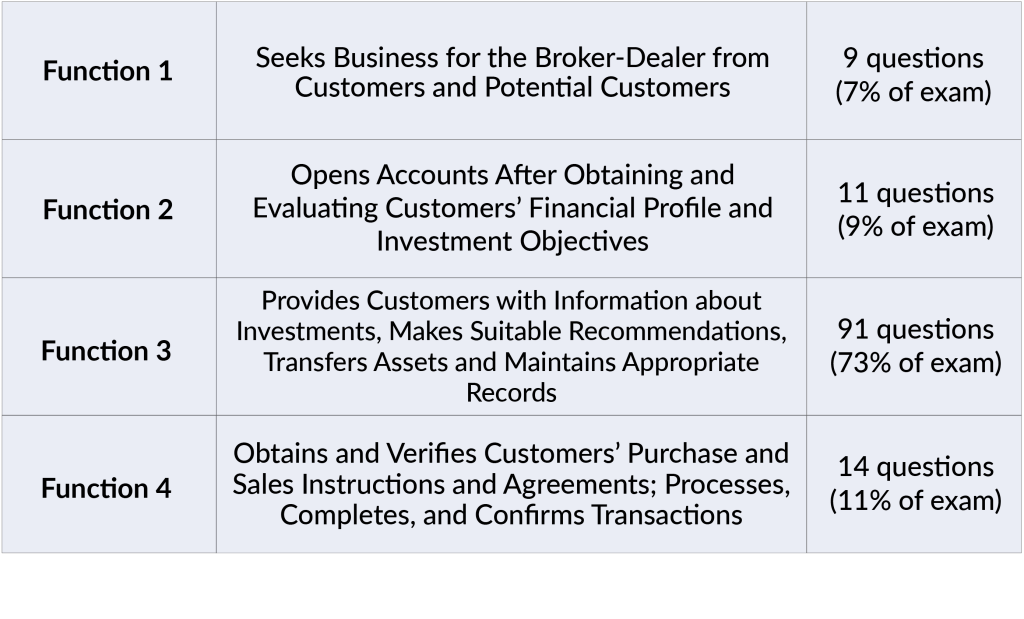

The questions on the Series 7 exam cover the main job functions of a general securities representative, as determined by FINRA:

FINRA updates its exam questions regularly to reflect the most current rules and regulations. Solomon recommends that you print out the current version of the FINRA Series 7 Content Outline and use it in conjunction with the Solomon Series 7 Study Guide. The Content Outline is subject to change without notice, so make sure you have the most recent version.

Question Types on the Exam

The Series 7 exam consists of multiple-choice questions, each with four options. You will see these question structures:

Closed Stem Format:

This item type asks a question and gives four possible answers from which to choose.

When interest rates go up, what will happen to the price of typical preferred stock?

-

- It will go up.

- It will go down.

- It will stay the same.

- It is unrelated to interest rates, so it is impossible to tell.

Incomplete Sentence Format:

This kind of question has an incomplete sentence followed by four options that present possible conclusions.

The owner of a house with a market value of $450,000 and an assessed value of $300,000, and with an ad valorem tax of 4 mills would pay a property tax of:

-

- $1,800

- $1,200

- $12,000

- $18,000

“EXCEPT” Format:

This type requires you to recognize the one choice that is an exception among the four answer choices presented.

VRDOs may have their rates automatically reset at any of the following frequencies except:

-

- Daily

- Weekly

- Monthly

- Yearly

Complex Multiple-Choice (“Roman Numeral”) Format:

For this question type, you see a question followed by two or more statements identified by Roman numerals. The four answer choices represent combinations of these statements. You must select the combination that best answers the question.

A Build America Bond may:

-

- Provide a 35% subsidy on the interest as a tax deduction

- Reimburse the issuer for 35% of the interest paid to investors

- Provide a 35% subsidy on the interest as a tax credit

- Provide a 35% subsidy on the interest as an additional interest payment

-

- I or II

- I or IV

- II and III

- III and IV

This format is also used in items that ask you to rank or order a set of items from highest to lowest (or vice versa), or to place a series of events in the proper sequence.

The flow of funds requirement for a municipality with a net revenue pledge usually prioritizes the following funds in which order, going from highest priority to lowest priority?

-

- Debt service fund

- Debt service reserve fund

- Operations and maintenance fund

-

- I, II, III

- III, I, II

- II, I, III

- III, II, I

Answers: B, B, D, C, B

For an even better idea of the possible question types you might encounter on the Series 7 exam, try Solomon Exam Prep’s free Series 7 Sample Quiz.

Taking the Series 7 Exam

The Series 7 exam can be taken at a Prometric test center or remotely online using Prometric’s ProProctor system. If taking the exam at a test center, you will be given a dry erase pen and whiteboard or a pen and scratch paper, and a basic electronic calculator. You cannot bring notes, paper, or your own calculator. Phones and watches are not permitted either. Due to COVID-19, you are required to wear a mask the whole time you are at the test center. Solomon recommends taking timed practice exams in the Series 7 Exam Simulator while wearing a mask to get used to this added discomfort.

If you’re thinking about taking the test from the comfort of your own home or office with ProProctor, it’s important to be aware of the strict procedures you must follow. See this user guide for complete details. And for a first-hand account of the remote testing experience, read this Solomon blog post.

Test-Taking Tips

Whether you take the exam in person or online, it helps to keep some test-taking strategies in mind. You have an average of slightly more than a minute and a half per question, so don’t spend too long on one question—this may cause you to run out of time and not get to other questions you know. If you don’t know the answer to a question, guess at the answer and “flag” it. You will not be penalized for guessing.

After you have finished all the questions, you can come back to any flagged questions. Not only does this strategy allow you to efficiently answer the ones you know, but it can also help because you might learn something later in the exam that may help you answer an earlier question. Just remember to save enough time to return to the questions you didn’t answer. However, it is not a good idea to simply skip all of the difficult questions with the intention of answering them later. You should make a serious effort to answer each question before moving on to the next one, as your thoughts are often clearer early on in the exam-taking process than they will be later.

How to Study for the Series 7 Exam

Follow Solomon Exam Prep’s proven study system:

-

- Read and understand. Read the Solomon Study Guide, carefully. The Series 7 is a knowledge test, not an IQ test. Many students read the Study Guide two or three times before taking the exam. To increase your ability to focus while reading, or as an alternative to reading, listen to the Solomon Series 7 Audiobook, which is a word-for-word reading of the Study Guide.

- Answer practice questions in the Solomon Exam Simulator. When you’re done with a chapter in the Study Guide, take 4–6 chapter quizzes in the Solomon Series 7 Online Exam Simulator. Use these quizzes to give yourself practice and to find out what you need to study more. Make sure you read and understand the question rationales. When you’re finished reading the entire Study Guide, review your handwritten notes once more. Then, and only then, start taking full practice exams in the Exam Simulator. Aim to pass at least six full practice exams and try to get your Solomon Pass Probability™ score to at least an 80%; when you reach that point, you are probably ready to sit for the Series 7 exam.

Use these effective study strategies:

-

- Take handwritten notes. As you read the Study Guide, take handwritten notes and review your notes every day for 10 to 15 minutes. Studies show that the act of taking handwritten notes in your own words and then reviewing them strengthens learning and memory.

- Make flashcards. Making your own flashcards is another powerful and proven method to reinforce memory and strengthen learning. Solomon also offers digital flashcards for the Series 7 exam.

- Research. Research anything you do not understand. Curiosity = learning. Students who take responsibility for their own learning by researching anything they do not understand get a deeper understanding of the subject matter and are much more likely to pass.

- Become the teacher. Studies show that explaining what you are learning greatly increases your understanding of the material. Ask someone in your life to listen and ask questions. If you don’t have anyone, explain it to yourself. Studies show that helps almost as much as explaining to an actual person (see Solomon’s previous blog post to learn more about this strategy!).

Take advantage of Solomon’s supplemental tools and resources:

-

- Use all the resources. The Series 7 Resources folder in your Solomon student account has helpful study tools, including several documents that summarize important exam concepts. There are also detailed study schedules that you can print out – or use the online study schedule and check off tasks as you complete them.

- Watch the Video Lecture. This provides a helpful review of the key concepts in each chapter after reading the Solomon Study Guide. Take notes to help yourself stay focused.

-

Good practices while studying:

- Take regular breaks. Studies show that if you are studying for an exam, taking regular walks in a park or natural setting significantly improves scores. Walks in urban areas or among people did not improve test scores.

- Get enough sleep during the period when you are studying. Sleep consolidates learning into memory, studies show. Be good to yourself while you are studying for the Series 7: exercise, eat well, and avoid activities that will hurt your ability to get a good night’s sleep.

You can pass the FINRA Series 7 Exam! It just takes focus and determination. Solomon Exam Prep is here to support you on your path to becoming a general securities representative.

To explore all Solomon Exam Prep’s Series 7 study materials, including product samples, visit the Solomon website here.

For more helpful securities exam-related content, study tips, industry updates, and promotional offers, join the Solomon email list. Just click the button below: