IAR CE FAQs (frequently asked questions)

Solomon has compiled some of the most common frequently asked questions about the new IAR CE requirement and how Solomon IAR CE works:

Why is there a new CE requirement for IARs?

CE courses are designed to keep a financial professional up to date on industry developments, current regulations, and ethical standards. NASAA received support from state regulators and the securities industry for the creation of a CE program to ensure that IARs, like broker-dealer agents, insurance agents, certified financial planners, and real estate agents, maintain or expand their level of knowledge and competence throughout their careers.

Who must complete IAR CE?

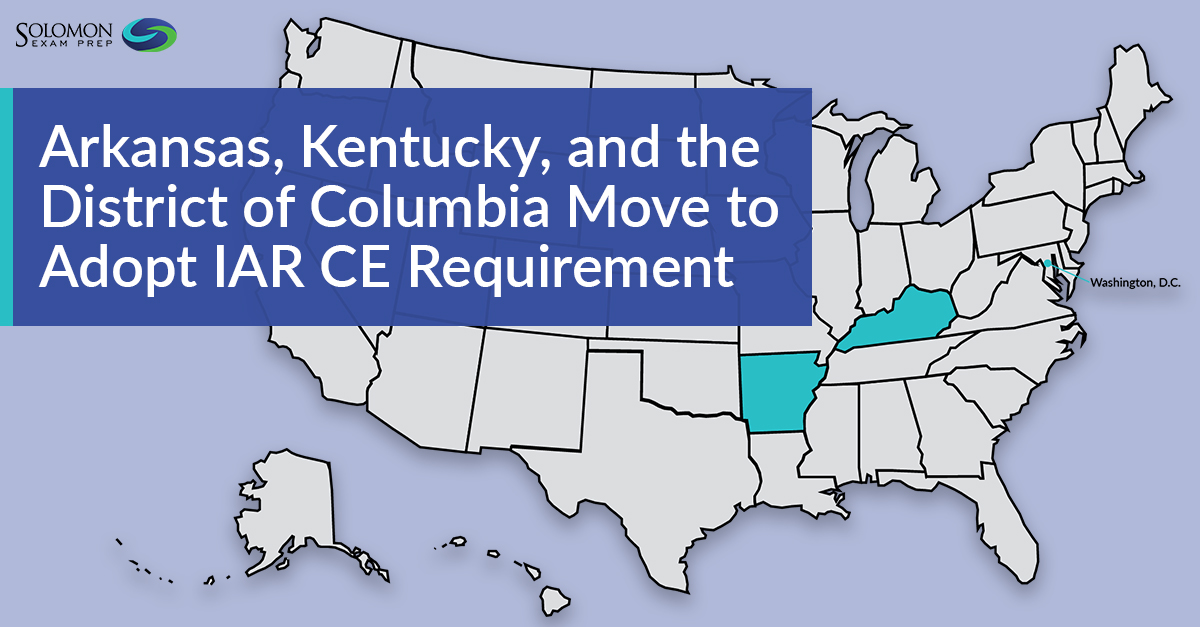

Every investment adviser representative (IAR) registered in a jurisdiction that adopts the NASAA model rule is subject to the CE requirement. The requirement applies to all registered IARs of both state-registered and federal-covered investment advisers. IARs must meet the CE requirements of any state in which the IAR is registered.

When do IARs need to start complying with the CE program?

Compliance starts in the 2022 calendar year in states that have adopted the model rule with an effective date of January 1, 2022. To view the states that adopted the new CE requirement, see the NASAA website or the Solomon IAR CE webpage. CE credits must be reported by the end of each calendar year. Newly registered IARs must meet the annual IAR CE requirement by the end of the first full calendar year following the year in which they first become registered.

How many courses do I have to take?

You have to complete 12 credits of CE coursework per year. Six of the 12 credits must be in the Products and Practices category. The other six credits must be in the Ethics and Professional Responsibility category, at least three of which must specifically be about ethics. The category that each course belongs to is indicated in the Solomon IAR CE course library. All Solomon courses are at least one credit.

Where can I take NASAA-approved courses?

NASAA has approved several vendors to provide IAR CE courses, including Solomon Exam Prep. All of the courses in the Solomon IAR CE library have passed an approval process with NASAA and Prometric, the course management vendor.

How are the courses delivered?

Solomon Exam Prep’s IAR CE courses are delivered online and are self-paced, so students can study when and where they like.

Do I have to pass an assessment to complete a course?

Yes, every course has an assessment that is at least 10 questions in length. In Solomon IAR CE courses, the assessment is broken up into shorter assessments that appear throughout the course, instead of a single assessment at the end of the course. You must pass assessments with a score of 100%, and you have an unlimited number of attempts. You may also be asked to complete a satisfaction survey as part of the course activities.

If I earn more than 12 IAR CE credits in a calendar year, can I carry over extra credits to the next year?

No, credits earned beyond the 12 required credits do not carry over into a subsequent year.

What happens if I do not complete the IAR CE requirement by the end of the calendar year?

You will be required to pay the registration renewal fee, and CRD will set your IAR CE status to “CE Inactive.” This status will appear in the Investment Adviser Public Disclosure (IADP) and in BrokerCheck. You can continue to do business; however, if IAR CE is not completed by the end of the subsequent year, you will not be able to renew your registration. An IAR that is CE Inactive will hold that status in all states where the CE rule is effective following adoption of the model. If a state has not yet adopted the CE model rule, the CE program will have no impact on the registration status of the IARs registered with that state – the current registration practices will remain the same.

Do I need to make up missed CE credits?

Yes. If you complete courses in the current year, those credits will first apply to the previous year if you hadn’t completed 12 credits in the previous year. Once the missing credits for the previous year have been completed, then additional courses taken in the current year will apply to the current year’s requirement. Remember that any excess credits completed in a year will not carry forward to the next year.

Who reports course completion?

The course provider (i.e. Solomon Exam Prep) reports course completion to FINRA, NASAA’s vendor for program tracking. IARs should still keep a record of their completed courses for their own records. Solomon Exam Prep will distribute a course completion notice, once credits are reported, for this reason.

Is there a reporting fee?

Yes, the reporting fee, also known as the roster fee, is $3 per credit hour. For Solomon IAR CE courses, the reporting fee is included in the cost of the course or membership. Solomon submits the reporting fee and course completion information to FINRA, the manager of NASAA’s CE reporting database.

How do I make sure my completion of the annual IAR CE requirement is shown in FINRA’s CE reporting database?

The course provider (i.e. Solomon Exam Prep) is responsible for reporting successful completion information to both the IAR and to FINRA. To do this, Solomon must collect the IAR’s CRD number, and first and last names. The IAR is responsible for communicating this information to Solomon when prompted. The IAR is also responsible for ensuring they receive documentation of courses completed and keeping track of the number of CE credits awarded for each course.

For more information about IAR Continuing Education, visit the NASAA FAQs page.