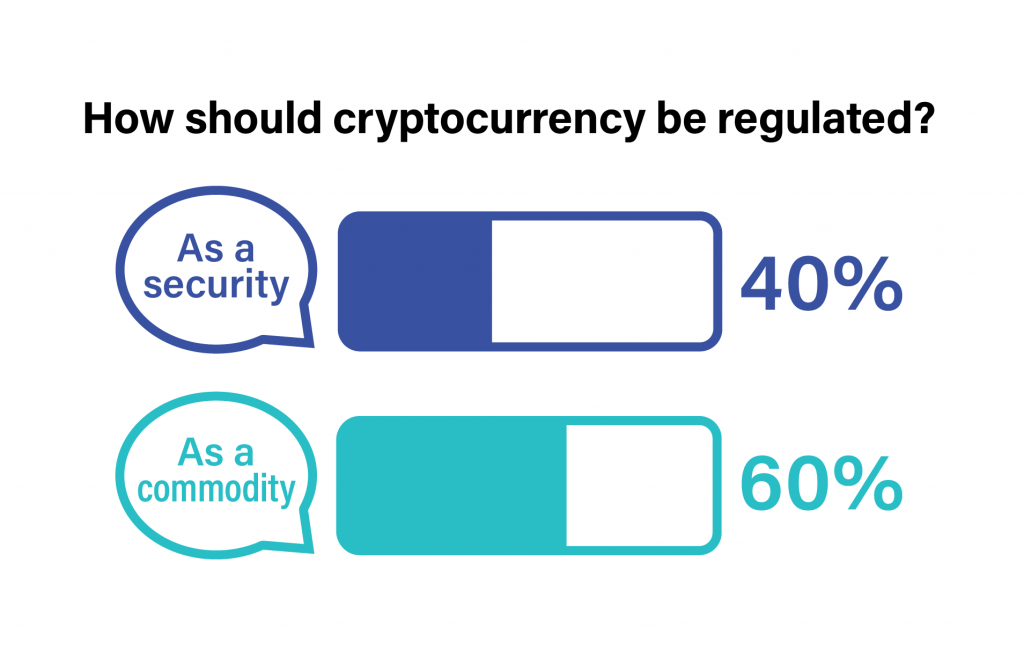

With the regulatory status of Bitcoin and other cryptocurrencies still up in the air, a recent Solomon LinkedIn poll found that 60% of Solomon customers think cryptocurrencies should be treated as commodities, while 40% said they thought cryptocurrencies should be regulated as securities.

Thus far the SEC has avoided clearly stating that cryptocurrencies are securities. To do so, the SEC would likely have to show that cryptocurrencies meet the “Howey Test,” which says that securities must have four characteristics. According to this test, a security involves (1) an investment of money that (2) involves a common enterprise (3) in which the investors expect to make a profit, and (4) the profits will be derived from the efforts of someone other than the investor.

If the SEC, Congress, or the courts declare that cryptocurrencies meet the Howey Test and are therefore securities, Solomon’s got you covered with the Series 7 General Securities Representative Exam Guide. This FINRA license allows you to engage in “the solicitation, purchase and/or sale of all securities products.”

If cryptocurrencies don’t meet the Howey Test, they could be regulated as commodities. These are goods such as wheat, gold, and pork bellies. Why might cryptocurrencies fit in with these others? Because commodities are all highly standardized so that they can be freely bought and sold on exchanges without worrying about differences in quality—every ounce of gold is pretty much like every other ounce of gold. Likewise, every Bitcoin is like every other Bitcoin.

If cryptocurrencies end up being treated like commodities, consider the Solomon Series 3 National Commodities Futures Exam Guide. The Series 3 is the main qualification exam for the National Futures Association and is required if you want to become a Commodity Trading Advisor.