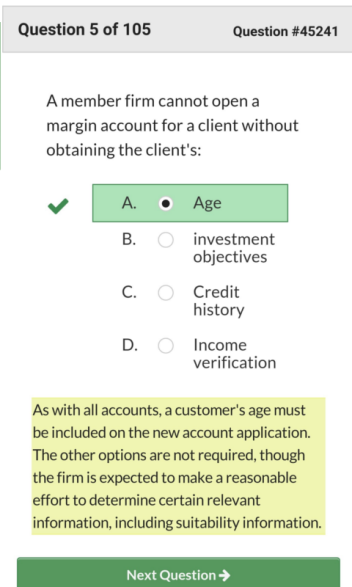

If you’ve ever traded securities or studied for a securities licensing exam, then you’ve probably come across T+3. No, it’s not an herbal supplement or an embarrassing medical procedure. Continue reading

If you’ve ever traded securities or studied for a securities licensing exam, then you’ve probably come across T+3. No, it’s not an herbal supplement or an embarrassing medical procedure. T+3 refers to the regular-way settlement period for most securities transactions. This means that securities must be paid for and delivered by three business days from the trade date. T+3 also means you don’t become the owner of record of a security until three business days after you purchase it.

Well, add T+3 to the list of things that have gone out of style. Effective May 30, 2017, the SEC will shorten the regular-way settlement period to two business days. And so will begin the age of T+2, which is intended to “increase efficiency and reduce risk for market participants,” according to SEC Acting Chairman Michael Pinowar.

This shorter settlement period for the trading of secondary market securities has been discussed by the SEC for years. The change is expected to lower margin requirements for clearing agency members, reduce liquidity stress when markets are volatile, and harmonize settlement with European markets, which moved to T+2 in 2014.

This settlement period will not apply to every securities transaction, though. T+2, like T+3 before it, will apply to:

- Stocks

- Bonds

- Municipal securities

- Exchange-traded funds

- Mutual funds traded through a brokerage firm

- Unit investment trusts

- Limited partnerships that trade on an exchange

The securities industry moves fast. Don’t get left behind! Visit www.solomonexamprep.com or call us at 503-601-0212 for more information about the latest securities exam preparation and education.

Solomon has helped thousands pass their Series 6, Series 7, Series 24, Series 26, Series 27, Series 28, Series 50, Series 51, Series 52, Series 53, Series 62, Series 63, Series 65, Series 66, Series 79, Series 82, and Series 99.

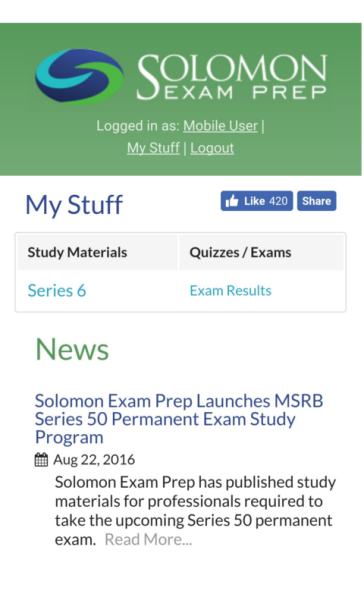

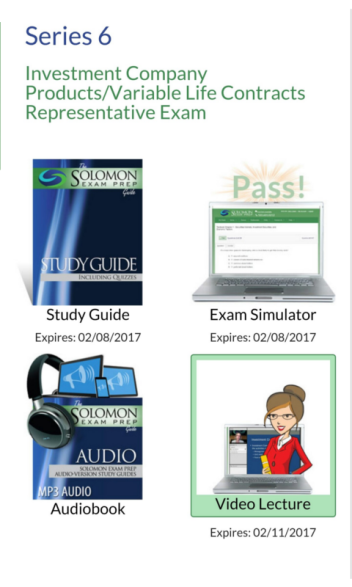

Solomon Exam Prep is pleased to announce that PreLicense.com has chosen to partner with Solomon Exam Prep to provide an online study program for the Series 6 and Series 63 qualification exams. PreLicense.com’s new Series 6 and Series 63 courses include the Solomon study guide,

Solomon Exam Prep is pleased to announce that PreLicense.com has chosen to partner with Solomon Exam Prep to provide an online study program for the Series 6 and Series 63 qualification exams. PreLicense.com’s new Series 6 and Series 63 courses include the Solomon study guide, exciting partnership.”

exciting partnership.”