Panel discussion May 24, 2016 at the FINRA annual conference. John Kalohn, Joe McDonald and Roni Meikle from FINRA discussed coming restructure of qualification exams.

Goals of exam restructure:

• Respond to industry and regulatory changes

• Reduce redundancy of content across exams

• Streamline exam process

• Minimize impact and change to the registration rules

• Ensure registered reps have a solid breadth of understanding of securities industry

Another goal appears to be a desire by FINRA and member firms to expand the number of people who can and will get licensed to work in the securities industry.

Exam restructure launch date has been postponed, at least a year, till January 2018 at the earliest.

Exams slated to be retired, will not be retired till 2018 restructure launch date. These include the Series 11 (Order Processing Assistant), Series 42 (Options Representative), Series 62 (Corporate Securities Representative) and Series 72 (Government Securities Representative) exams. The panel noted that only one person had taken the Series 72 in the past year.

Anyone holding registrations that are being retired (Series 11, Series 62, Series 72) will be able to continue to hold them until they leave industry for more than 2 years.

Series 17/37/38 Exams – FINRA will retire these exams and use the UK and Canadian certifications to exempt certificate holders from the Essentials Exam.

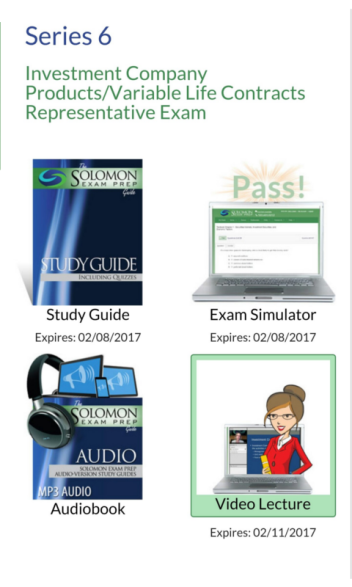

Exams that will remain as “Top-off” exams: Series 6, 7, 22, 57, 79, 82, 86/87 and 99. Top-off exams will be shorter than current exams.

Essentials Exam features:

Essentials exam currently envisioned to be 100 questions long.

Unlike the current system, you will not need to be associated with a member firm to take the Essentials Exam. In other words, you won’t need to have a job with a broker-dealer to take the Essentials Exam.

If you pass the Essentials Exam, it will be valid for 4 years from your passing date.

Just passing the Essentials Exam will not be enough to qualify you to be a registered person with FINRA. To become a registered person, you will have to have a job with a FINRA member firm, file a U4, get finger-printed, and pass a Top-off exam.

What if you are currently registered?

Current registrants will maintain registration(s) without the need for additional testing.

Most current registrants will be considered to have passed the Essentials Exam, and it will be valid for 4 years upon leaving the securities industry.

Registrants who return to the securities industry within 2 years will regain registration without needing to take the Essentials or Top-off exam.

Registrants who return to the securities industry between 2 and 4 years later will not need to take the Essentials Exam, only the Top-off exam for the registration position.

Registrants who return to the securities industry more than 4 years later will need to take both the Essentials and the top-off exam.

Next steps:

Securities Essentials Exam is being finalized by FINRA and committee of industry representatives.

Top-off exam outlines to be released 9-12 months prior to launch date of exam restructure

Prepare CRD and other FINRA systems for new exam

structure

Create a system for persons not associated with a member to enroll and pay for the Essentials Exam

Make registration rule, fee and qualification exam filings with the SEC in 2016

FINRA says exam restructure will do the following for firms:

• Give firms an opportunity to employ new business models for onboarding staff.

• Allow firms to better gauge industry knowledge of interns and other potential employees.

• Allow non-registered staff (e.g., administrative) to take Essentials Exam.

• Create a larger pool of potential new registered persons

Impact on firms

Firms will have choices of how to onboard new reps:

• Request applicants take and pass Essentials Exam prior to making job application

• Have new hires take Essentials Exam-only initially and then take top-off qualification exam

• Have new hires take both Essentials Exam and top-off exam together

Other info related to exam restructure:

• Through CRD, firms will be able to confirm whether and when an individual passed the Essentials Exam.

• Top-off exams will retain traditional names: i.e., Series 7 exam will remain the Series 7 exam.

• Position designations in CRD will remain the same (i.e., GS will remain GS [Series 7]).

• Firms will be able to schedule the Essentials Exam for support personnel through CRD.

• Current registrants will not need to take the Essentials Exam to maintain current registrations.

• Principal exams and registrations will not be directly affected.

Principal Exams

Under the new representative-level program structure, several principal exams cover subject matter already covered on the Essentials and the Top-off exams.

Example – Series 24 Exam major topic areas include:

• Sales practice (Series 7)

• Investment banking (Series 79)

• Trading (Series 57)

• Research (Series 86/87)

As a result of this, FINRA will develop a principal exam structure that builds on the new representative-level exam structure to reduce redundancy in content and better focus on testing knowledge of and ability to apply supervisory level rules and concepts

With post-Brexit vote market turmoil, it’s good to remember that the Securities Exchange Commission requires trading halts across US markets in the event that stocks fall more than specified percentages in one day. This information is also important to know if you are studying for securities licensing exam such as the Series 7, Series 24, Series 26, Series 62, Series 79, and the Series 65.

With post-Brexit vote market turmoil, it’s good to remember that the Securities Exchange Commission requires trading halts across US markets in the event that stocks fall more than specified percentages in one day. This information is also important to know if you are studying for securities licensing exam such as the Series 7, Series 24, Series 26, Series 62, Series 79, and the Series 65.