If you’re planning to take the NASAA Series 63, Series 65, or Series 66 exam, you can expect to see questions about when broker-dealers and their securities agents need to register in a particular state. You can also expect to see questions about when investment advisers and investment adviser representatives need to register in a state. Instead of feeling intimidated when confronted with such questions, you should relax, smile, and feel confident. That’s because if you follow the simple rules that we’re about to describe, you should get each of these questions right.

Broker-Dealers and Their Agents

First let’s deal with questions about state registration for broker-dealers (BDs) and their agents. Rule number one here is that when a U.S.-based BD or one of its agents has an office located in a state, that BD or agent must register in the state. It does not matter which types of clients a BD or BD agent with an office in a state has or what types of securities those clients buy from the BD or agent. A BD or agent with an office in a state must register in that state. Period.

What about a BD or BD agent that doesn’t have an office in a state? If a BD or BD agent without an office in a state has any non-institutional clients in that state, the BD or agent must register there. However, if the BD or agent without an office in a state has only institutional clients in the state, no registration in that state is required. Institutional clients include the issuers of securities involved in a specific transaction; other broker-dealers; and institutional buyers, which are big-money entities such as banks, insurance companies, mutual funds, and pension and profit-sharing plans.

Key takeaway:

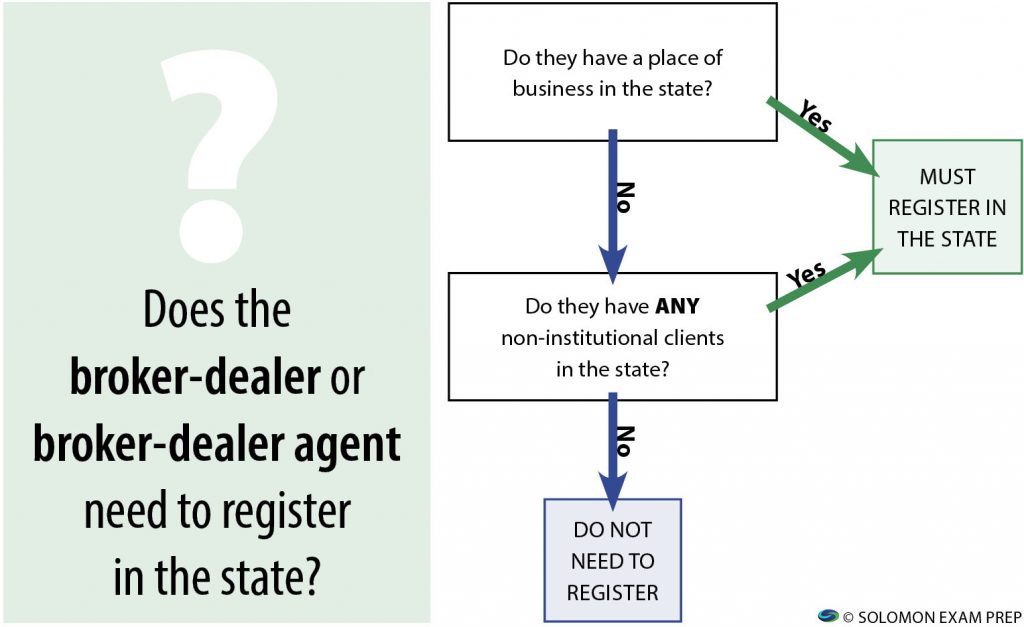

So when presented with a question about whether a specific broker-dealer or one of its agents must register in a given state or states, there are two potential questions to ask yourself. The first question is: “Does the broker-dealer or BD agent have an office in the state?” If the answer is yes, it’s simple: the BD or agent must register in that state. End of questions. However, if the answer is no, move on to the second question: “Does the BD or BD agent have any non-institutional clients in the state?” If the answer is yes, the BD or agent must register in the state; if the answer is no, they do not need to register in the state.

Here’s a flowchart to help you remember the question-answering process:

Investment Advisers and Their Representatives

Now let’s look at the state registration requirements for investment advisers that do not register with the SEC. If the investment adviser has an office in the state, it must register there. If the investment adviser doesn’t have an office in the state but has had more than five non-institutional clients in the state during the past twelve months, it also must register there. The rules are the same for investment adviser representatives who work for an investment adviser that does not register with the SEC.

Investment adviser representatives who work for investment advisers that register with the SEC — also known as federal covered advisors — may need to register with the state if they have an office in the state.

Key takeaway:

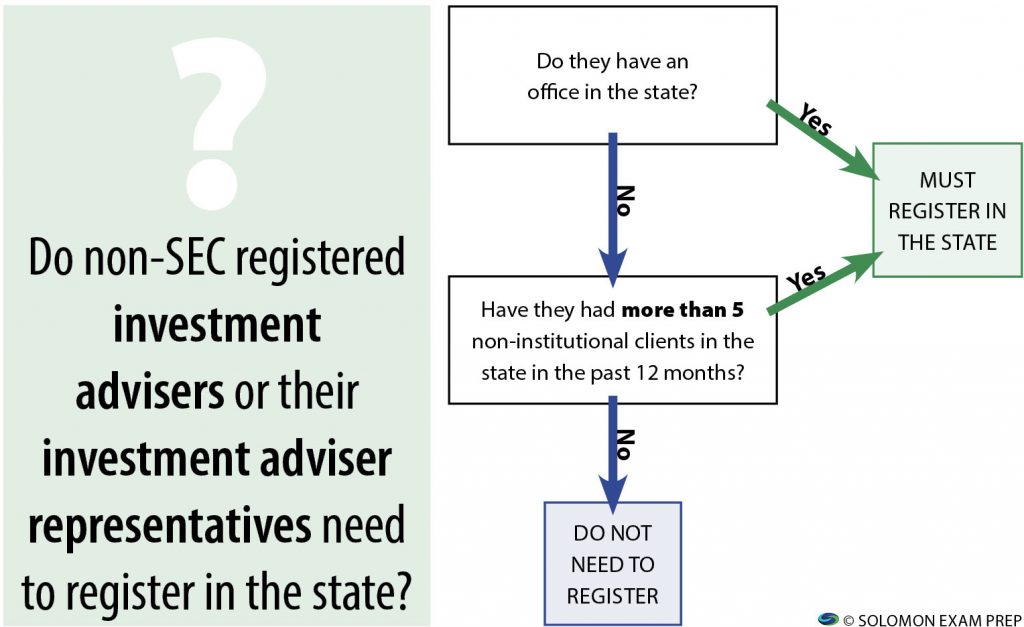

So if you see a question about state registration requirements for non-SEC registered investment advisers or their investment adviser representatives, the first question to ask yourself is: “Does the IA or IAR have an office in the state?” If the answer is yes, you know the IA or IAR must register there. If the answer is no, move on to the second question: “Has the IA or IAR had more than five non-institutional clients in the state during the preceding twelve months?” If the answer is yes, they must register in the state; if the answer is no, they don’t need to register in the state.

Here’s another flowchart to help you with this type of question:

Remember that if an investment adviser registers with the SEC, it is a federal covered adviser and does not need to register in any state. Instead, a federal covered adviser must notice file to provide investment advice to residents of that state. When it comes to notice filing requirements for federal covered advisers, follow the same thought process as that described above. If the federal covered adviser has an office in a state, it must notice file there. If it has no office in the state but it has had more than five non-institutional clients in the state in the past twelve months, the firm must also notice file there.

Practice question

Simple, right? So let’s put the suggested thought process into practice by looking at a question like one you may see on your exam.

XYZ Broker Dealer has its main office in State A. It also has offices in States B and C. XYZ has non-institutional clients in states A and B, but it only has institutional clients in State C. It does not have an office in State D, but it has three non-institutional clients there. In which states does XYZ need to register?

A. State A only

B. States A and B only

C. States A, B, and C only

D. States A, B, C, and D

Remember the process to follow when you see questions about where a BD must register. There are two possible questions to address as part of that process.

First question: Does the broker-dealer have an office in a state? Answer: XYZ has offices in each of States A, B, and C. Recall that if the answer the first question is “yes, the BD has an office in the state”, then the BD must register in that state. So XYZ needs to register in States A, B, and C.

If the answer to the first question is no, as it is for State D, you move on to the second question: Does the BD have any non-institutional clients in the state? XYZ has non-institutional clients in State D, so the answer is yes to that question. If the answer to the second question is yes, this means the BD must register in the state. Thus, XYZ has to register in State D as well as States A, B, and C. So Choice D is the correct answer.

So now you’re an expert, and you’re one step closer to passing your Series 63, Series 65, or Series 66 exam!

Want more exam tips?

Watch a video version of “How to Answer State Registration Questions on the Series 63, Series 65, and Series 66” on the Solomon YouTube channel, where you’ll find even more exam and study tips!

Solomon Exam Prep has helped thousands pass their securities licensing exams, including the SIE and the Series 3, 6, 7, 14, 22, 24, 26, 27, 28, 50, 51, 52, 53, 54, 63, 65, 66, 79, 82 and 99.

The Securities and Exchange Commission announced last week that next April it plans to introduce a fiduciary standard for broker-dealers. Since last month when the Department of Labor issued its fiduciary rule for tax-advantaged retirement accounts, the securities industry has been waiting to see if the SEC would join the Department of Labor in a push to raise the legal and ethical standards for broker-dealers and agents.

The Securities and Exchange Commission announced last week that next April it plans to introduce a fiduciary standard for broker-dealers. Since last month when the Department of Labor issued its fiduciary rule for tax-advantaged retirement accounts, the securities industry has been waiting to see if the SEC would join the Department of Labor in a push to raise the legal and ethical standards for broker-dealers and agents.