Underwriting Compensation

For both competitive bids and negotiated sales, underwriters are compensated by the difference between the price they pay the issuer for the bonds and the price at which they resell them to the public. This difference is called the spread, which is made up of several components. The managing underwriter gets a percentage of the entire issue, each of the syndicate members gets a percentage of the sales they make, and if a selling group is participating, they get a cut as well.

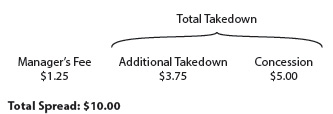

We will describe the components of the spread in terms of bond points. A bond point is equivalent to 1% of the face value of a bond. For a bond having a face value of $1,000, one point is worth $10. Let’s assume that the bonds for a new issue will have a face value of $1,000 and the underwriters’ spread is one point. That means for every $1,000 bond sold, the underwriters as a group will receive $10.

The manager’s fee is the payment to the lead underwriter for services rendered. This fee, which might be in the neighborhood of 1/8 point, comes off the top before any other profits are allocated among the membership. The remainder of the spread is called the total takedown fee. In our example, the syndicate member would receive 7/8 of a point, or $8.75. The total takedown fee is equal to the difference between what the syndicate member pays the lead underwriter for a bond and what the syndicate member charges the public.

Suppose the price that syndicate members pay the lead underwriter for the bonds is $991.25. When the syndicate sells the bonds to the public at face value ($1,000), it pockets the difference of $8.75. This $8.75 is what the syndicate members receive as commission (7/8 point), assuming they sell the securities themselves.

|

Distribution of Spread to Syndicate Members |

|

|

If, instead, a syndicate member offe