If you work at a FINRA member firm and want to become a registered representative, you’ll need to pass a job-specific FINRA licensing exam. One such exam is the Private Securities Offerings Representative Exam, also known as the Series 82. The Series 82 exam is half the length it once was (50 questions instead of 100), but it hasn’t become much easier. How should you prepare for the exam?

Solomon Exam Prep is delighted to release the 5th edition of “The Solomon Exam Prep Guide: Series 82 FINRA Private Securities Offerings Representative Exam.” With this updated version of the Study Guide, professionals who want to become a registered Private Securities Offerings Representative can learn the content they need to know to pass the Series 82 exam. Passing the Series 82, along with the co-requisite Securities Industry Essentials (SIE) Exam, qualifies an individual for the sale of private placement securities as part of a primary offering.

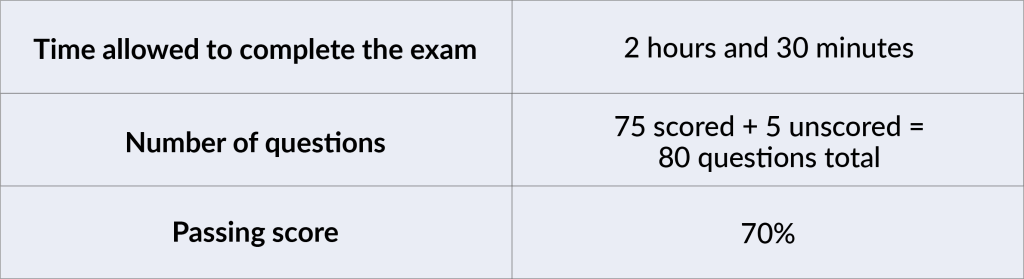

About the Series 82 Exam

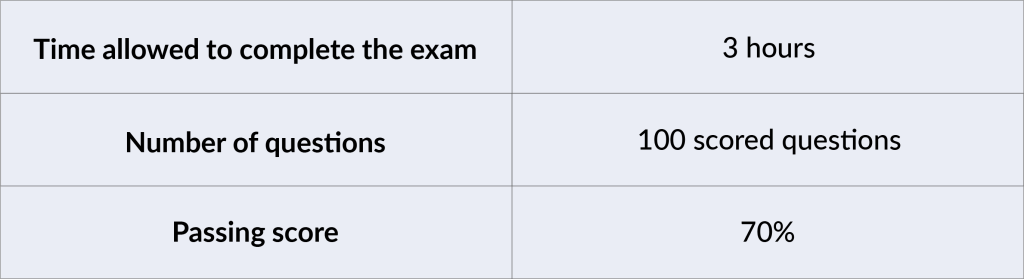

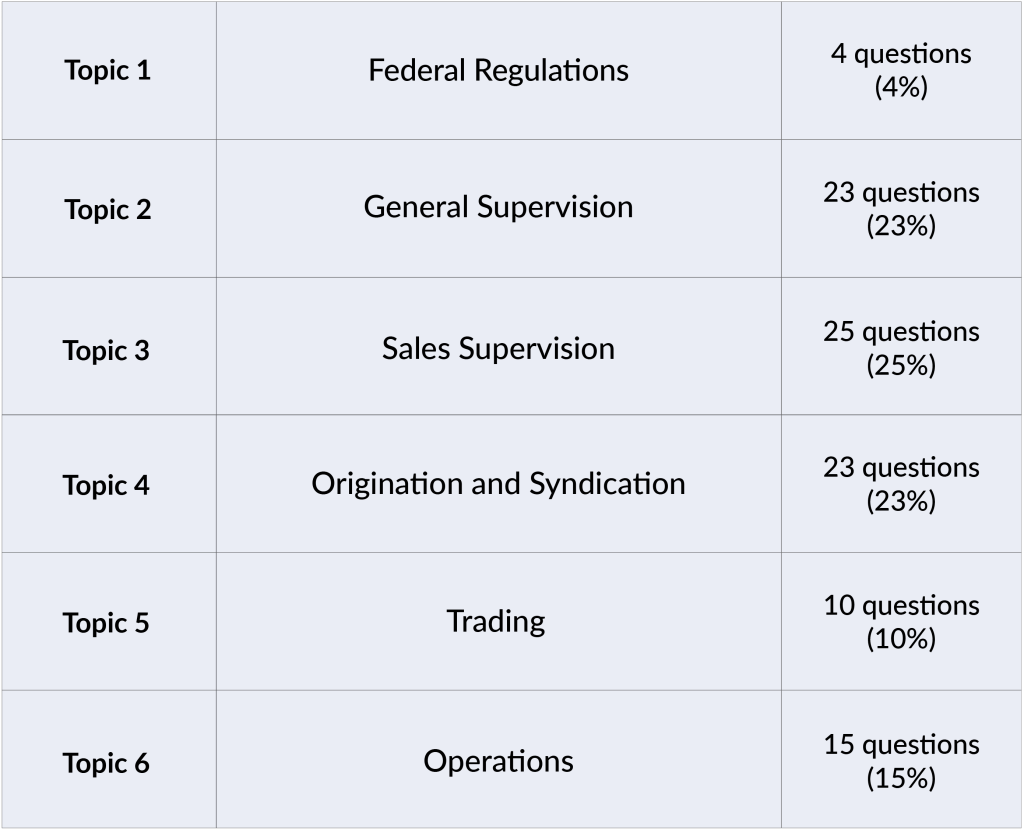

The Series 82 is a fairly difficult exam that requires candidates to study a wide range of securities, regulations, and market information. Exam topics are divided into four sections:

- Section 1: Seeks Business for the Broker-Dealer from Customers and Potential Customers

- Section 2: Opens Accounts After Obtaining and Evaluating Customers’ Financial Profile and Investment Objectives

- Section 3: Provides Customers with Information About Investments, Makes Suitable Recommendations, Transfers Assets and Maintains Appropriate Records

- Section 4: Obtains and Verifies Customers’ Purchase Instructions and Agreements; Processes, Completes and Confirms Transactions

To help prepare candidates for this challenging exam, the Solomon Series 82 Study Guide is continually kept up to date to reflect current rules and regulations, and it covers all key exam topics. Charts, graphs, and practice questions throughout the text support learners in understanding and applying important concepts.

What changes with this new edition?

The core content of the Series 82 Study Guide remains the same, but some important changes include:

- Expanded and updated discussion of Regulation D private placements, including the SEC’s new definition of accredited investors

- A new section with extensive coverage of Regulation Best Interest and the new suitability requirements it imposes on BDs

- Information about the SEC’s new, higher exempt offering dollar caps

- Added discussion of the SEC’s new Rule 152, which has a major impact on how exempt offerings retain their exempt status

- Updated and expanded explanation of crowdfunding

- Updated and expanded coverage of using finders to identify potential investors

- Revamped discussion of member private offerings rules

- Additional coverage of gifts and charitable donations

- Information about the SEC’s fair disclosure rules

Content updates for this new edition are also reflected in the Solomon Series 82 Exam Simulator. The online Exam Simulator complements the Study Guide with over 1,700 practice questions for the Series 82. Hone, track, and assess your knowledge by taking unlimited chapter quizzes and full exams to practice what you’ve learned.

Series 82 Study Materials

The Series 82 Study Guide is available as a digital subscription with a hardcopy upgrade option. You can purchase the Study Guide individually or in a package with supporting Series 82 study products. Customers also have access to free tools and resources, including a study schedule in digital and pdf formats, which helps you master the exam material with maximum efficiency.

To learn more about Solomon Exam Prep’s Series 82 study materials, including Study Guide, Exam Simulator, Audiobook, Video Lecture, and Flashcards, visit the Solomon Series 82 product page.

Series 82 Exam Practice Questions

Test your Series 82 knowledge! The questions below come from Solomon’s industry-leading Exam Simulator:

1. A Regulation A (also called Regulation A+) offering is for a maximum amount of securities of:

- $75 million or less during a 6-month period

- $75 million or less during a 12-month period

- $10 million or less during a 12-month period

- $10 million or less during a 6-month period

2. What is the equivalent taxable yield of a 6.5% municipal bond if the investor’s tax bracket is 25%?

- 18.5%

- 8.67%

- 6.5%

- 4.88%

3. According to Regulation D, which of the following are NOT considered “accredited investors?”

- A married couple with an annual joint earned income of $250,000 for two years

- An individual with an annual earned income of $250,000 for each of the last two years

- An individual with a net worth of $1,500,000, not counting his or her home

- All are considered

Answers: 1) B. 2) B. 3) A.

For more Series 82 practice questions and to try out the Solomon Exam Simulator, take Solomon’s free Series 82 Sample Quiz!