On May 28, 2015 at the FINRA annual conference in Washington, DC, a panel of FINRA and industry representatives discussed proposed changes to restructure FINRA’s representative-level qualification program and fielded questions from attendees present at the meeting.

According to Joe McDonald, Senior Director, Testing and Continuing Education Department, FINRA plans to reduce the number of representative-level examinations, currently numbering 16, in order to simplify the examination program and reduce the amount of redundancy across exams. FINRA proposes to do this by restructuring the current exam program into a format whereby all potential representative-level registrants would take a core general-knowledge exam and then additional specialized knowledge exam(s). The general knowledge exam is being called the Securities Industry Essentials Examination (SIE) or “essentials exam,” and the specialized exams are being called “top-off” exams. According to McDonald, the proposed changes will restructure the exam program without rewriting registration rules.

The SIE, or essentials exam, content would include knowledge fundamental to working in the securities industry, such as basic product knowledge, structure and functioning of the securities markets, regulatory agencies and their functions, basic economics, professional conduct, and regulated and prohibited practices. A significant change in this restructure proposal is that individuals taking the SIE would not need to be associated with or sponsored by a FINRA member firm. Also, since the content of the essentials exam would be stable and less likely to change than the content on the top-off exams, a passing result on the SIE would be valid for 4 years, instead of the current 2 years for FINRA exams. This should make employment in the securities industry more accessible, flexible, and appealing.

Passing the SIE alone would not qualify an individual for registration with FINRA. To be eligible for registration, an individual who has passed the SIE would also need to pass the appropriate top-off exam pertaining to one’s job function. If, following an individual’s registration with a firm, the job functions for which the individual is registered change and one needs to become registered in an additional or alternative representative-level position, one would not need to pass the SIE again. Rather, the registered individual would need to pass only the appropriate top-off exam.

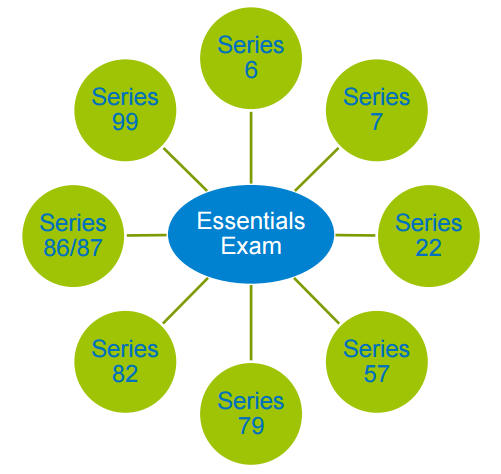

Each top-off exam would correlate to a current representative exam and registration position (e.g., Series 7 and General Securities Representative) and would test content specific to that registration category or job function. In addition, several of the current registration categories would be retired, reducing the number of representative-level qualification exams from the current 16 to the following 9:

The essentials exam is expected to be 75-100 questions in length and the specialized top-off exams are expected to be shorter than the current representative exams. For example, the Series 7 is expected to be 150 questions in length, rather than the current 250 questions.

As part of the restructuring, FINRA is proposing to retire the current registration categories of Options Representative, Corporate Securities Representative and Government Securities Representative as well as the associated exams, the Series 42, Series 62 and Series 72, respectively.

FINRA is considering retiring the U.K. Securities Representative registration (Series 17) and the Canadian Securities Representative registrations (Series 37 & 38). Additionally, due to technological changes, FINRA is considering retiring the Order Processing Assistant registration (Series 11).

Under the proposal, representative-level registrants who are registered, or had been registered within the past 2 years, prior to the effective date of the proposal would be eligible to maintain those registrations without being subject to any additional requirements. This means that most currently-registered individuals would be considered to have taken the SIE and it would be valid for 4 years after they leave the securities industry. Further, such individuals, with the exception of an Order Processing Assistant Representative, would be considered to have passed the SIE in FINRA’s CRD system; thus, if they wish to register in any additional representative category after the effective date of the proposal, they could do so by taking only the appropriate top-off exam. However, with respect to an individual who is not registered on the effective date of the proposal but was registered within the past two years prior to the effective date of the proposal, FINRA will administratively terminate the individual’s SIE status in the CRD system if such individual does not register with FINRA within 4 years from the date of the individual’s last registration.

FINRA says it will begin implementing changes in late 2016, starting with the SIE exam and 3 specialized exams that make up the majority of all registrations: the Investment Company and Variable Contracts Products Representative (Series 6), the General Securities Representative (Series 7), and the Investment Banking Representative (Series 79) registration categories. FINRA says the remaining top-off exams will be implemented in the first half of 2017.

Panelists at the FINRA meeting said that they are beginning to look at the principal-level qualification exam program to identify an opportunity for similar restructuring.

Questions and answers from the 2015 FINRA Annual Conference audience included:

Q. Will it be possible to take the essentials and top-off exams on the same day?

A. Yes.

Q. What about failing and retaking?

A. If you fail the first time, FINRA says it will keep the same 30/30/180 day requirement.

Q. Will the exam question style change?

A. No, FINRA says the current question and answer style will remain the same: a multiple-choice question with four answer choices.

Q. Will the essentials content be on the top-off exams?

A. No.

Q. Will there be a CE requirement for the essentials exam?

A. No.

Q. How will you keep the essentials exam questions secure?

A. New security measures to prevent questions from being stolen are being developed. Also, FINRA says it has exam question pool rotation will be increased, meaning the exam questions will cycle faster than they have historically.

Q. What about the FINRA exam waiver program, will it be affected?

A. Yes, it will affect the program, but FINRA is not sure exactly how.

Q. Will the restructure affect state registration?

A. FINRA has been in touch with NASAA about the proposed exam changes and since FINRA, with the exception of retiring some registration categories, is not modifying registration rules, state registrations should not be affected much if at all.

You can find more information about the proposed restructure at: http://www.finra.org/sites/default/files/notice_doc_file_ref/Notice_Regulatory_15-20.pdf

The FINRA Notice seeks comment on the proposal from the industry and other interested persons. You can email comments to pubcom@finra.org. The comment period ends July 27.

Before becoming effective, the proposed rule change must be authorized for filing with the Securities and Exchange Commission (SEC) by the FINRA Board of Governors, and then must be filed with the SEC.