What does the FINRA Series 14 allow me to do?

The FINRA Series 14, also known as the Compliance Officer Exam, is a principal-level exam that qualifies you to serve as a compliance officer for a broker-dealer, including being designated as the Chief Compliance Officer (CCO) of a broker-dealer in its SEC registration. The Series 14 was designed to make sure that individuals who have day-to-day compliance responsibilities or supervise others engaged in compliance activities have the knowledge necessary to carry out their job responsibilities.

There are two ways to achieve the Compliance Officer qualification: pass the SIE, Series 7, and Series 24 exams, or pass just the Series 14 exam. In other words, by taking the Series 14, you get to take one exam instead of three. For this reason, the Series 14 is broader, deeper, and more difficult than most FINRA exams. Passing the Series 14 requires knowledge of compliance issues related to a broad range of broker-dealer activities, from the mechanics of trading to the details of the underwriting process to the publication of research reports.

You must be associated with a FINRA member firm in order to take the Series 14.

About the Exam

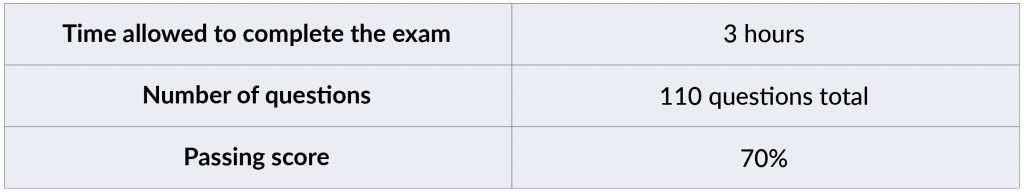

The Series 14 exam consists of 110 multiple-choice questions covering the nine sections of the FINRA Series 14 exam outline. FINRA updates its exam questions regularly to reflect the most current rules and regulations.

Note: Scores are rounded down to the lowest whole number (e.g. 69.9% would be a final score of 69%–not a passing score for the Series 14 exam).

Topics Covered on the Exam

FINRA divides the Series 14 exam into nine areas. These areas are organized by the types of knowledge that a compliance officer will need to know to complete various job functions.

The Series 14 exam covers many topics including the following:

-

- Components of a satisfactory supervisory system as defined by FINRA

- Rules and mechanics of the securities markets

- Margin requirements

- Sales practices

- Types of brokerage accounts

- Separation of research and investment banking

- Net capital requirements

- Registration requirements for firms and associated persons

- Business continuity plans

- Customer identification and anti–money laundering compliance

Question Types on the Series 14

The Series 14 exam consists of multiple-choice questions, each with four options. You will see these question structures:

Closed Stem Format:

This item type asks a question and gives four possible answers from which to choose.

Under Rule 144, what is the holding period for stock purchased in the open market by a control person?

-

- Two years

- One year

- Six months

- No holding period

Incomplete Sentence Format:

This kind of question has an incomplete sentence followed by four options that present possible conclusions.

According to NYSE rules, a block of stock is defined as:

-

- 10,000 shares, or a quantity with a market value of $150,000 or more, whichever is less.

- 10,000 shares, or a quantity with a market value of $200,000 or more, whichever is less.

- 20,000 shares, or a quantity with a market value of $200,000 or more, whichever is less.

- 20,000 shares, or a quantity with a market value of $200,000 or more, whichever is more.

“EXCEPT Format”

This type requires you to recognize the one choice that is an exception among the four answer choices presented.

All of the following require the successful completion of one or more exams except a:

-

- specialist

- trader

- securities lending representative

- two-dollar broker

Complex Multiple-Choice (“Roman Numeral”) Format:

For this question type, you see a question followed by two or more statements identified by Roman numerals. The four answer choices represent combinations of these statements. You must select the combination that best answers the question.

Which two of the following employees of a member organization must be registered and qualified under NYSE Rule 345?

-

- An employee with authority to bind the firm to a contract involving securities activities

- An employee who only trades for the firm’s account and does not transact business with the public

- An employee with duties and responsibilities similar to those of a registered representative

- A supervisor of an employee who solicits business for the firm from another member firm

-

- I and III

- I and IV

- II and III

- II and IV

This format is also used in items that ask you to rank a set of statements from high to low or to place a series of events in the proper sequence.

In which order, from first to last, are the following actions performed during the underwriting of an issue of corporate securities?

-

- The holding of a due diligence meeting

- Investigation and analysis of the issuer

- The filing of a registration statement

- Distribution of the red herring to customers giving indications of interest

-

- I, II, III, IV

- II, III, I, IV

- III, I, II, IV

- IV, II, III, I

Study Strategies for the Series 14

-

- Use all the resources. The Resources folder in your Solomon student account has helpful information, including a detailed study schedule that you can print out – or use the online study schedule and check off tasks as you complete them.

- Read and understand. It’s simple: read the Solomon Study Guide, carefully. The Series 14 is a knowledge test, not an IQ test. Many students read the Study Guide two or three times before taking the exam.

- Take handwritten notes. As you read the Solomon Series 14 Study Guide, take handwritten notes and review your notes every day for 10 to 15 minutes. Studies show that the act of taking handwritten notes in your own words and then reviewing these notes strengthens learning and memory.

- Make flashcards. Making your own flashcards is another powerful and proven method to reinforce memory and strengthen learning.

- Research. Research anything you do not understand. Curiosity = learning. Students who take responsibility for their own learning by researching anything they do not understand get a deeper understanding of the subject matter and are much more likely to pass.

- Answer practice questions in the Solomon Exam Simulator. When you’re done with a chapter in the Study Guide, take 4 – 6 chapter quizzes in the Solomon Exam Simulator. Use these quizzes to give yourself practice and to find out what you need to study more. Make sure you read and understand the question rationales. When you’re finished reading the entire Study Guide, review your handwritten notes once more. Then, and only then, start taking full practice exams in the Exam Simulator. Aim to pass at least six full practice exams and try to get your average score to at least an 80; when you reach that point, you are probably ready to sit for the Series 14 exam.

- Take regular breaks. Studies show that if you are studying for an exam, taking regular walks in a park or natural setting significantly improves scores. Walks in urban areas or among people did not improve test scores.

- Get enough sleep during the period when you are studying. Sleep consolidates learning into memory, studies show. Be good to yourself while you are studying for the Series 14: exercise, eat well, and avoid activities that will hurt your ability to get a good night’s sleep.

You can pass the FINRA Series 14! It just takes work and determination. Solomon Exam Prep is here to support you on your journey to becoming a FINRA-registered Compliance Officer.

For more helpful securities exam-related content, study tips, and industry updates, join the Solomon email list. Just click the button below: