MSRB Rule G-18, effective March 21, 2016, establishes a best-execution rule for municipal security transactions. The rule requires brokers and dealers to make reasonable efforts to find as favorable a price as possible for a customer’s transaction, given the prevailing conditions of the market. G-18 is comparable to FINRA Rule 5310, though it is designed specifically to meet the needs of the municipal securities market.

In deciding how and where to execute a trade, a broker-dealer is expected to consider these factors:

• The character of the market for the security, such as its price, volatility, and liquidity

• The size and the type of transaction

• The number of markets checked

• The information reviewed to determine the current market for the security or similar securities

• The accessibility of the quotation

• The terms and conditions of the transaction as communicated to the broker-dealer

Because municipal securities trade over-the-counter, the term “market” should be interpreted broadly to include trading among broker’s brokers, alternative trading systems, or other counter-parties. Dealers must be especially vigilant with transactions in markets where trading is thin and limited pricing information is available.

If a dealer does not get the best price possible in the market, this does not necessarily mean that reasonable diligence was not used. However, if the dealer makes another trade soon after and gets a better price for a similar security and there has been no significant change in the market, this is an indicator that the dealer did not use reasonable diligence.

The following are a few examples of characteristics that may be used to determine if two securities are similar:

• Issuer

• Source of repayment

• Credit rating

• Coupon

• Maturity

• Redemption features

• Sector of the market

• Geographical region

• Tax status

Broker-dealers must institute written policies and procedures that address how they will make a best-execution determination in the absence of pricing information or multiple quotations. They must document compliance with those policies and conduct reviews at least once a year to assess their effectiveness.

Broker-dealers are exempt from the best execution requirement when acting on behalf of a sophisticated municipal market professional (SMMP). An SMMP is:

• A bank, savings and loan association, insurance company, or investment company

• A registered investment adviser

• Any other individual or entity having total assets of at least $50 million

Note: Because broker-dealers are not considered to be customers, the best-execution standard does not have to be applied to trades between broker-dealers that are not on behalf of a customer.

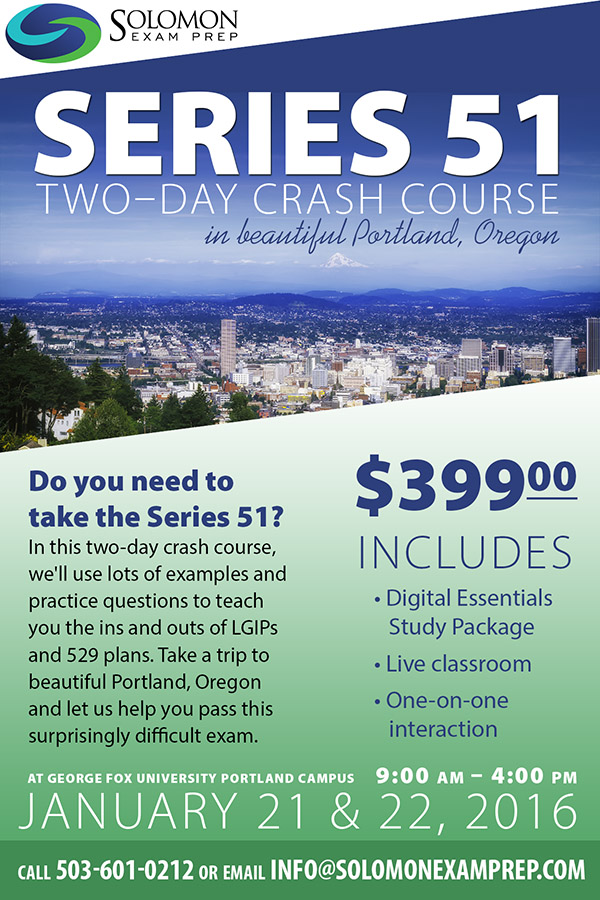

This post is relevant to the Series 52 and Series 53.